The infoshot to help kick-start your week

Last Week

- Chancellor Jeremy Hunt chose to delay the much-anticipated plan on UK’s tax and spending by over 2 weeks, moving it to 17th The move settled investors and lessened the urgency for a new economic plan. Due to the calmer market conditions, the Government will not have to pay as much interest on debt, as it is deemed less risky. Official projections believe the Government’s bill for the interest on its debt has fallen by up to £10bn compared to a few weeks ago.

- Following the appointment of PM Rishi Sunak, and the announcement of the delay of Hunt’s economic plan, the pound rose sharply against the dollar, trading above $1.16, up around 1.2% on the day of the announcement. The currency has rallied in recent times as investors believe former hedge fund manager Sunak is a safer bet than his predecessor. It is important to note however, that the rally also reflects a weakening dollar.

- The ECB announced on Thursday a 75 basis point rate hike ahead of inflation data this Monday, as well as scaling back support for European banks. TLTROs, or targeted long-term refinancing operations are a tool which provides EU banks with attractive borrowing conditions to incentivise lending to the real economy, but in recent times, the ECB has been increasing rates faster than expected. As a result, EU lenders have been benefitting from TLTROs as well as higher rates; the situation has been described as almost a ‘bank subsidy’.

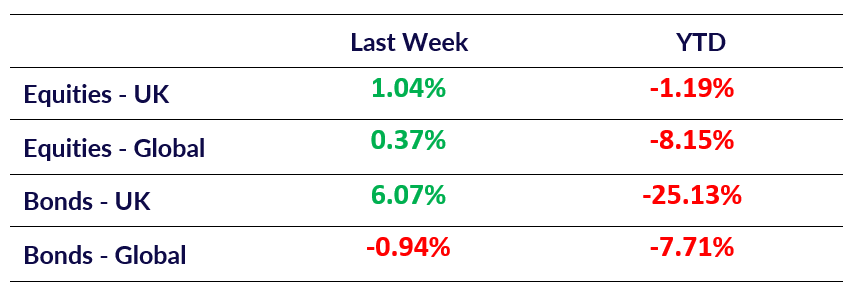

Market Pulse

Coming Up

- EU Consumer Price Index (Oct YoY) released 31st October, projected to come in at 10.2%.

- Fed Interest Rate Decision released 2nd November, projected to be a 75 bps hike.

- BoE Interest Rate Decision released 3rd November, projected to be a 75 bps hike.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel