The infoshot to help kick-start your week

Last Week

Despite recent fragility in the banking sector, the Fed followed the ECB’s example, opting to raise rates despite fears that the move could add to recent financial turmoil. They raised the key rate by 25 bps, calling the banking system “sound and resilient”. While markets remain volatile following the collapses of SVB and Signature bank, as well as the Credit Suisse situation in Europe, the Fed’s Powell stated that they were “outliers” in an otherwise strong financial system, adding that they remain focused on the inflation battle.

In the UK, the cost of living rose more than expected last month, with inflation in the year actually rising from 10.1% in January to 10.4% in February. While fuel prices have continued to come down, the continued rise in food costs had been a big factor in February’s number, coming at a time where supermarkets were experiencing a shortage of vegetables and other items. The news came as a disappointment to many; however the BoE showed resilience in its commitment to bringing down prices and implanted a 25 bps hike.

Despite the chaos in the banking sector in the US and Europe, economists at Citi have marked China as a ‘relative safe haven’ this year. While investor sentiment was dampened last year amid COVID controls and regulatory uncertainty, those controls have ended and policymakers have been clearer with their direction. Activity momentum could increase further, following stabilisation in the auto and real estate markets, and China could see accelerated growth this year, while western economies face heightened risk of financial disruption.

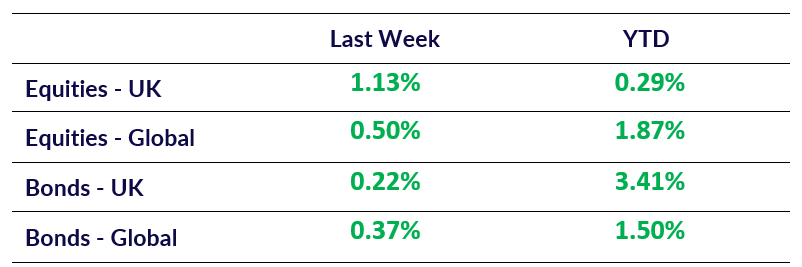

Market Pulse

Coming Up

- BoE Inflation Letter released March 30th.

- UK GDP Data released March 31st, 7:00 am.

- EU CPI data (Mar YoY) released March 31st 10:00 am.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel