The infoshot to help kick-start your week

US launches airstrikes on Caracas and captures Maduro

Early on Saturday morning, the US launched airstrikes on military bases in Caracas before kidnapping Venezuelan President Nicolas Maduro from his compound. Maduro is now in New York facing an indictment from the Department of Justice accusing him of narco-terrorism, cocaine importation and various weapons charges. Trump has vowed to “run the country” until there is a “proper” transition of power in Venezuela and has also threatened to take similar action against Columbia and Mexico.

At Mar-a-Lago on Saturday, Trump claimed US oil giants are ready to rebuild the Venezuelan oil industry saying, “We’re going to have our very large US oil companies – the biggest anywhere in the world – go in, spend billions of dollars, fix the badly broken infrastructure and start making money for the country”. Despite currently only exporting 1% of the world’s consumed oil, Venezuela is home to 17% of the world’s oil reserves. The country officially nationalised its oil industry on 1 January 1976 and in 2007 took control of all remaining private arrangements aside from operations run by Chevron. US oil firms have been largely silent since the events on Saturday. Increasing production is likely to require a massive investment. Rystad Energy estimate that increasing oil production to 2 million barrels a day by the early 2030s could cost as much as $110bn. Regardless, the share prices of US oil firms like Chevron, ExxonMobil and ConocoPhilips have jumped up during trading today. The price of oil fell slightly but remains steady at around $57 to $58 a barrel.

US manufacturing ramps up but demand falls

The latest S&P Global US manufacturing release showed US manufacturers ramped up production again in December while new orders fell. Chris Williamson, the Chief Business Economist at S&P Global Market Intelligence described the situation as something of a “Wile E. Coyote scenario” where “factories are continuing to produce goods despite suffering a drop in orders.” The gap between production growth and the decline in new orders is now the widest it’s been since the global financial crisis.

Saks Global CEO steps down as luxury retailer reportedly faces bankruptcy

Richard Baker, the CEO of luxury retailer Saks Global, resigned on Friday amid reports the business is preparing for bankruptcy. According to the Wall Street Journal, the company has missed an interest payment exceeding $100mn on debt from its merger with Niemen Marcus in December 2024. We’ve seen several luxury brands file for bankruptcy over the last 12 months, including Lugano Diamonds & Jewellery Inc and S SENSE as the sector struggles with a slowing demand from US and Chinese consumers and Trump’s tariffs. Bain & Company recently estimated that the global luxury consumer base has fallen from roughly 400 million to around 340 million in the last three years.

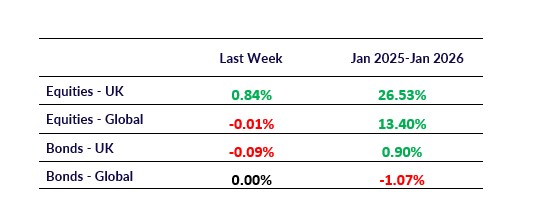

FTSE 100 hits 10,000 points for the first time

Here in the UK, the FTSE 100 went above 10,000 points for the first time ever on Thursday. The New Year rally places the index 21% up on where it was a year ago, outperforming all major US indexes. Rachel Reeves said the breakthrough was “a vote of confidence in Britain’s economy and a strong start to 2026”.

OpenAI advertises for new Head of Preparedness

In what could be one of the toughest and most consequential job roles of 2026, OpenAI posted a job advert for its new “Head of Preparedness” position on Monday.

The successful candidate will be responsible for evaluating and protecting against emerging threats from powerful competing AIs. They’ll be rewarded with a $550,000 salary and an unspecified slice of OpenAI shares. AI firms have been pretty much left to regulate themselves. As Yoshua Bengio, one of the godfathers of AI and a pioneer in the field of deep learning, recently put it, the AI field currently has less regulation than a “sandwich”…

Coming Up:

- S&P Global Services PMI, Tuesday 6 January 2026

- EU CPI, Wednesday 7 January 2026

- ADP Nonfarm Employment Change, Wednesday 7 January 2026

Notice:

For regulated financial advisers and investment professionals only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated but is not an indicator of potential maximum loss for other periods or in the future.