The infoshot to help kick-start your week

Trump’s ‘reciprocal’ tariffs send markets tumbling

Trump set out the full details of his ‘reciprocal’ tariffs after the markets shut on Wednesday evening. The response during trading on Thursday and Friday was unequivocal and markets across the globe suffered their steepest decline since the pandemic. On Friday the S&P fell 6%, the FTSE 100 dropped 4.95% and in Japan the Nikkei was down 7.8% when trading closed this morning.

While the markets knew the tariffs were coming, the crude methodology and maximalist nature of their setup and imposition has spooked investors. Essentially, Trump announced a broad ‘reciprocal’ tariff plan with two parts:

1. From Saturday (5 April) – a 10% baseline tariff on all imports from all countries (excluding Canada and Mexico)

2. From Wednesday (9 April) – additional tariffs on major trading partners, including China, India, Japan and the EU.

The level of tariff appears to be linked to the level of trade deficit the US has with its trading partners. Widely criticised by economists since its announcement, the formula focuses on imports (and seems to ignore the US’s large service sector surplus) and imposes a higher or lower tariff depending on the trade deficit that it finds. The baseline tariff of 10% has been imposed regardless of whether Trump’s formula shows that the US has a trade surplus. Trump has set custom tariffs for 60 “worst offenders”, including a 54% (including earlier tariffs) rate for China, 46% rate for Vietnam and a 20% rate on EU countries. Canada and Mexico are exempt from the baseline rate since they’ve already been hit by tariffs this year.

If the ‘reciprocal’ tariffs remain in place, we could see a decline in economic growth in the US and abroad, increasing the likelihood of a US recession and a global downturn. Goldman Sachs has slashed it’s forecast for US growth and lifted it’s 12-month recession probability from 35% to 45%. Following a weekend playing golf, Trump said on Sunday evening that he is “open to talking” to world leaders about new deals that could cut or remove tariffs. However, at the time of writing this morning, the market sell-off shows no sign of abating following comments from Trump last night that “sometimes you have to take medicine to fix something.”

UK to seek shelter from the storm

Last year, the UK exported nearly £60bn worth of goods to the US, largely machinery, cars and pharmaceuticals. In addition to the baseline tariff, a 25% tariff has been put on car exports, steel and aluminium. In response Jaguar has already announced it will “pause” all shipments to the US.

The Bank of England may be forced to reconsider its interest rate strategy, and investors piled more expectations on a rate cut last week, as central banks across the globe try to stave off a potential global recession. Analysis from KPMG estimates that Trump’s trade war could leave the UK economy £21.6bn worse off by 2027.

Starmer has said he is prepared to change policy to “shelter British businesses from the storm” while he continues to seek a trade deal with the US. Changes to Reeve’s fiscal limits or tax rises could be on the agenda, but Starmer was keen to point out that the government had resisted doing either in the Spring Statement a fortnight ago.

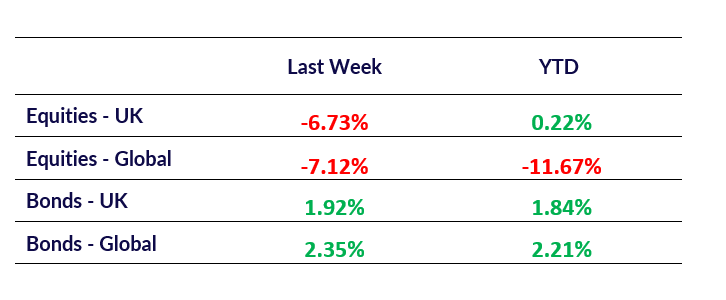

Market Pulse

Coming Up

- FOMC meeting, Wednesday 9th April 2025 at 18:00am

- Initial Jobless Claims, Thursday 10th April 2025 at 12:30am

- GDP (Mom), Friday 11th April 2025 at 6:00am

Notice:

For regulated financial advisers and investment professionals only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The value of investments can increase and decrease, past performance and historical data cannot guarantee future success, and any references to individual stocks or asset classes are made purely for illustrative purposes. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated but is not an indicator of potential maximum loss for other periods or in the future.