The infoshot to help kick-start your week

Last Week

- Asian stocks rose in a relief rally, following US markets higher after a soft inflation report, with the S&P 500 and Nasdaq 100 closing at record highs amid optimism over potential Federal Reserve interest-rate cuts. Despite some data being released early, markets were unaffected, and investors now anticipate two rate cuts this year, up from one expected earlier. However, uncertainty remains, with several Fed officials, including Loretta Mester, John Williams, and Thomas Barkin, calling for patience. This suggests that borrowing costs could remain high for longer to ensure inflation eases. JPMorgan CEO Jamie Dimon also expressed concern about inflation while ECB Executive Board member Isabel Schnabel warned against back-to-back interest-rate cuts in June and July.

- China’s consumer spending growth unexpectedly slowed in April, while industrial production accelerated, revealing a lopsided recovery in the world’s second-largest economy. This data caused Chinese stocks to drop as investors worried about the outlook. The export-driven manufacturing sector has been driving growth this year, but a housing crisis continues to suppress domestic demand. Home prices fell at a faster pace in April, worsening a property crash that could threaten millions of jobs.

- In the UK Jeremy Hunt has pledged to further cut national insurance in the autumn if economically feasible, emphasising the goal of eliminating the “double tax on work.” Labour went on to criticise the Conservatives for lacking clarity on funding such cuts, but Hunt refuted Labour’s accusations as “nonsense”. He stood by his claim that taxes would decrease under Conservative rule, but declined to provide a specific timeline for reductions, citing economic uncertainty.

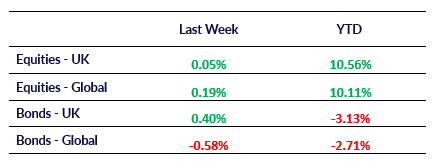

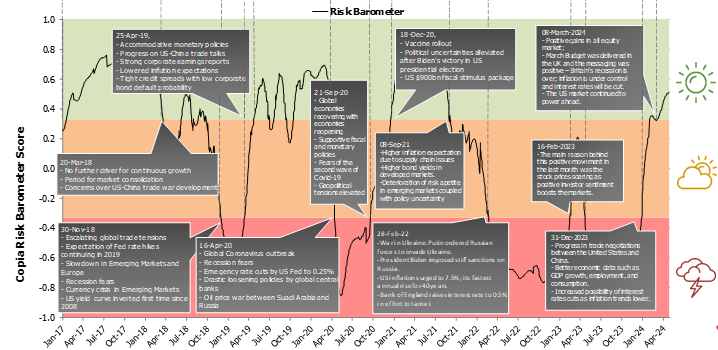

Market Pulse

Coming Up

- Bank of England Governor Bailey Speaks, Tuesday 21st May 2024 at 6:00pm.

- UK Consumer Price Index (CPI) data released, Wednesday 22nd May 2024 at 7:00am.

- UK Purchasing Managers Index (PMI) data release, Thursday 22nd May 2024 at 9:30am

Notice:

For professional advisers only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel