The infoshot to help kick-start your week

Last Week

- The Federal Reserve decided to maintain the benchmark federal funds rate at 5.25% to 5.5%, where it has stood since July. This decision reflects ongoing concerns about inflation, supported by recent data indicating persistent price pressures in the US economy. The Federal Reserve emphasised the necessity for further evidence of cooling price gains before considering rate cuts from their current two-decade high.

- On Wednesday afternoon, the Dow Jones Industrial Average and other U.S. stock indexes experienced a spike, largely in response to the Federal Reserve’s decision to leave interest rates unchanged and Federal Reserve Chair Jerome Powell’s statement that “it is unlikely the next policy move will be a hike” prompted the market’s positive reaction. The Dow surged by 500 points following this news. However, it later retraced most of those gains, closing up by 87 points, or 0.2%, at 37,903. In contrast, the S&P 500 and Nasdaq both ended the day with slight declines of 0.3%.

- Speculation surrounding potential intervention by Japanese authorities intensified following a late surge in the yen during New York trading, marking the second such occurrence within the week. However, the yen’s strength began to wane during Tokyo trading, partially reversing the earlier gains. The currency saw a notable increase of over 3%, reaching 153.04 per dollar, coinciding with significant trading activity involving yen-related futures totalling more than $4 billion during the final stages of the US trading session. Masato Kanda, Japan’s top currency official, refrained from commenting on whether Japan intervened, aligning with Tokyo’s strategy of maintaining ambiguity regarding its intervention stance.

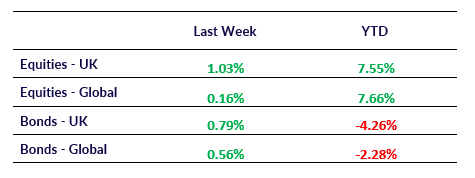

Market Pulse

Coming Up

- Halifax House Price Index released, Tuesday 7th May 2024 at 07:00am.

- Bank of England Interest rate decision, Thursday 9th May 2024 at 12:00pm.

- UK GDP data released, Friday 10th May 2024 at 07:00am

Notice:

For professional advisers only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel