The infoshot to help kick-start your week

Last Week

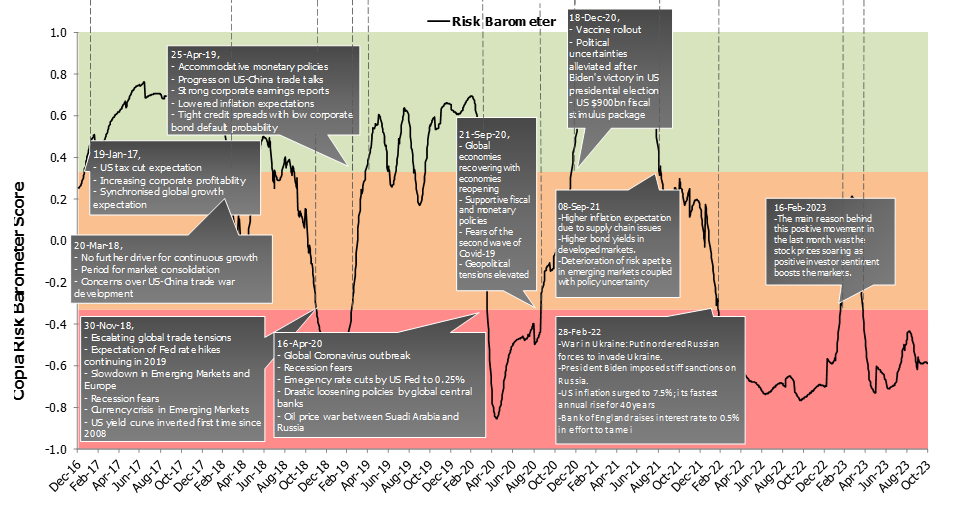

- The US Federal Reserve held interest rates steady on Wednesday for the third consecutive time as widely expected. The market reacted positively to comments from the Fed that indicated that its monetary policy tightening campaign was coming to an end and officials also suggested that rate cuts could be coming next year. The comments stimulated a rally in the stock and bond markets with the 10-year Treasury dipping below 4 per cent for the first time since August.

- The Bank of England also paused interest rates at 5.25% on Thursday with Governor Andrew Bailey indicating that there was still a way to go before inflation was brought back to target. The comments were less optimistic than those from the Fed the day before and UK government bonds partly reverted some of gains made from the Fed comments.

- UK business activity rose in December at its fastest pace for six months. The S&P Global flash UK PMI composite, which measures the health of manufacturing and services sectors, rose to 51.7 in December from 50.7 in November and came in higher than the expected 50.9. When the PMI sits above 50 it indicates that the majority of businesses are reporting growth.

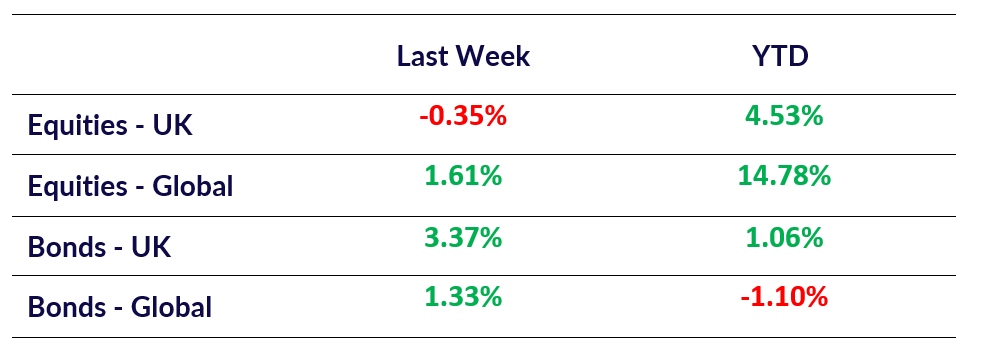

Market Pulse

Coming Up

- EU November CPI Data Released, Tuesday 19th December 2023 at 10:00am.

- UK November CPI Data Released, Wednesday 20th December 2023 at 7:00am.

- UK Q3 GDP Data Released, Friday 22nd December 2023 at 7:00am.

Notice:

For professional advisers only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel