The infoshot to help kick-start your week

Last Week

- Eurozone inflation fell more than expected to 2.4 per cent in November taking it to the slowest annual pace since July 2021. Inflation fell below the 2.9 per cent seen in October and sits under the 2.7 per cent that was expected by economists. Despite the positive news in the battle against inflation, the news comes shortly after Christine Lagarde insisted it was too early to start declaring victory in the push to bring inflation down.

- UK house prices unexpectedly rose for another month during November as the property market stabilises from an easing in high mortgage rates. House prices grew 0.2 per cent between October and November on top of the 0.9 per cent growth seen in the previous month. Despite the growth month-on-month, house prices are still down 2% from the same time last year.

- US bonds recorded their best monthly performance since 1985 in November. The Bloomberg US Aggregate Bond Index, a widely used measure of total US fixed income returns, rose approximately 4.3 per cent in November as it recorded its best monthly performance. Bond prices grew over November as investors bet that the Federal Reserve have finished its rate hiking campaign.

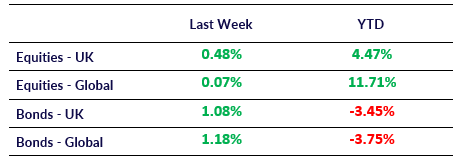

Market Pulse

Coming Up

- UK Composite PMI data released, 5th December at 9:30am.

- US Unemployment Rate released, 8th December at 1:30pm.

Notice:

For professional advisers only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel