The infoshot to help kick-start your week

Last Week

- US inflation came in higher than forecasted for September which, following continued strong data from the jobs market, continued to raise suggestions that the Federal Reserve may raise interest rates to offset inflation pressure. Despite economists expecting a slight decline, the consumer price index (CPI) sat at 3.7 per cent year on year – the same as what was seen a month before.

- Oil and gas prices rose higher at the end of last week as conflict within the middle east raised supply concerns. Brent crude reached over $90 a barrel on Friday although prices have not yet rebounded to the levels seen in late September. Analysts at JPMorgan believe that there is no immediate impact on global oil production but are keeping tabs to see if the dispute widens across the region.

- China’s financial sector authorities raised the prospect of setting up a stock market stabilisation fund to boost confidence within the country’s financial market. It has been reported that if the plan went ahead, the government money would be matched by partner funds and institutions and would likely go into domestic equities through existing institutions. The plan comes after months of uncertainty within Chinese capital markets.

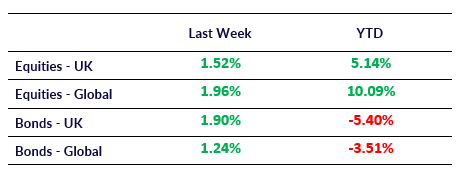

Market Pulse

Coming Up

- UK CPI September data released, 18th October at 7:00am.

- EU CPI September data released, 18th October at 10:00am.

- US initial jobless claims data released, 19th October at 1:30pm.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel