The infoshot to help kick-start your week

Last Week

- The US announced that 336,000 new jobs were added in September which was far more than the 170,000 jobs that were expected. Bonds sold off after the data was released as it became clear to investors that interest rates would have to stay higher for longer to battle inflation. Bonds recovered slightly on Friday from their initial sell-off but yields, which rise when bond prices fall, remained near their ten-year high.

- UK challenger bank, Metro Bank, has struck a deal to raise new funds after shares slumped last week over news that the bank had to raise more money to shore up its finances. The bank has raised £325m in new funding as well as £600m through a new debt refinancing. While shares rebounded in early Monday morning trading, they are still down 49% since last month.

- UK house prices dropped in September for the sixth consecutive month as high mortgage rates continue to impact the housing market. The average UK house price was down 0.4 per cent between August and September and are currently 4.7 per cent lower than the same time last year.

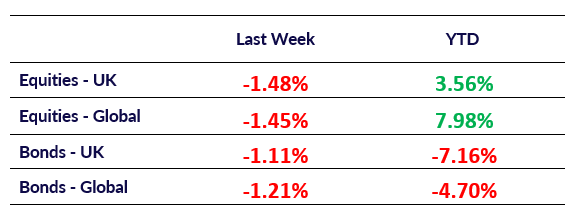

Market Pulse

Coming Up

- UK GDP August MoM data released, 12th of October, 7:00am.

- US September CPI data released, 12th of October, 1:30pm.

- US Initial Jobless Claims data released, 12th of October, 1:30pm.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel