The infoshot to help kick-start your week

Last Week

- Annual UK inflation dropped to 6.8 per cent in July down from 7.9 per cent a month below. The slowing of price rises was led by lower gas and electricity prices and resulted in the lowest inflation rate seen since February 2022. However, stripping out volatile food and energy prices, core inflation sat at 6.9 per cent and was unchanged from the previous month.

- UK house prices have reported their largest August dip since 2018 as the average UK asking prices drops 1.9% compared to the month before. This comes after four consecutive months of house price falls as UK homebuyers have been hit with higher borrowing costs in recent months. Despite this, according to data from Rightmove, average house prices remain nearly 20% higher than seen before the pandemic.

- Yields on long-term US government debt rose close to their highest levels since 2007 on Thursday. A sell-off in bonds, which increases yields, happened after minutes from the Federal Reserve’s last meeting suggested that interest rates could stay higher for longer. During the meeting, the committee noted there remained ‘significant upside risks to inflation’ and that this could require further tightening of monetary policy (higher interest rates) in the future

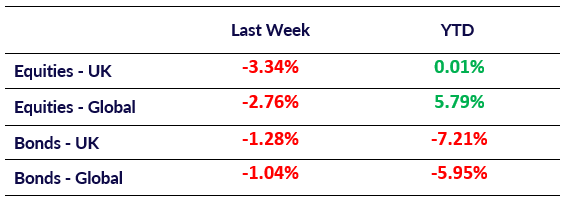

Market Pulse

Coming Up

- US July Existing Home Sales data released, August 22nd, 3:00pm.

- US Initial Jobless Claims data released, August 24th, 1:30pm.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel