The infoshot to help kick-start your week

Last Week

- US core inflation, which excludes volatile food and energy prices, increased only 0.2 per cent in July from the previous month. This was the same rate as seen in June and took annual inflation down to 4.7 per cent – the lowest level since October 2021. The new data has added to bets that the Federal Reserve will hold interest rates in September.

- UK GDP rose 0.2 per cent in the between April and June. This was higher than the 0.1 per cent growth that was seen in the previous two quarters and narrowly beat the Bank of England forecast of 0.1 per cent. This comes after the Bank of England stated it no longer forecasted the economy to fall into recession this year, instead expecting the economy to remain flat for a couple of years.

- Money markets attracted strong inflows in the week ending August 9th as investors shifted away from riskier assets. Investors shifted $73.17bn into global money market funds in the biggest inflow since March, data from Refinitiv showed. Alongside this, high-risk equities saw $11.7bn worth of outflows in the same period as investors looked to de-risk.

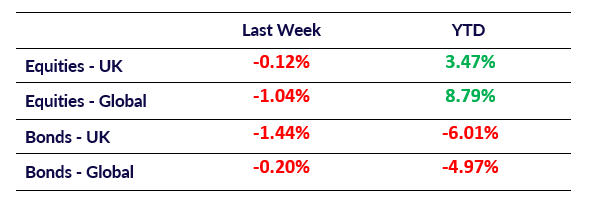

Market Pulse

Coming Up

- UK CPI data released, August 16th, 7:00am

- US Initial Jobless Claims data released, August 17th, 1:30pm

- EU CPI data released, August 18th, 10:00am

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel