The infoshot to help kick-start your week

Last Week

- On Friday, US stocks fell after new jobs data showed hiring beginning of slow. The US economy added 209,000 jobs in June, which was lower than the expected 240,000 and a sharp fall from the 309,000 jobs added in May. Despite this, wages grew more than expected in June and sat 4.4% higher than the same time last year. which settled investors’ concerns slightly.

- Halifax reported on Friday average property prices in the UK were down 2.6% in June compared to the same time last year. This is the largest fall in house prices since June 2011 as rising mortgage prices are reducing housing affordability and market demand as a result.

- On Wednesday, the UK paid the highest borrowing cost on two-year debt since the UK Debt Management Office was established in 1998. The gilt, which is maturing in October 2025, was priced with a yield of 5.688%. When this bond was first issued in January, this yield sat at 3.634%, highlighting the rapid growth in interest rates in the last six months.

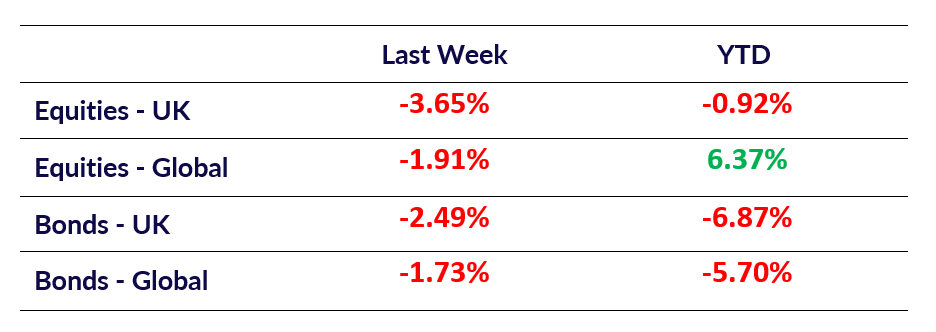

Market Pulse

Coming Up

- US June CPI data released, July 12th, 1:30pm

- UK May GDP (MoM) released, July 13th, 7:00am

- US Initial Jobless Claims data released, July 13th, 1:30pm

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel