The infoshot to help kick-start your week

Last Week

US inflation falls to lowest in more than a year, as the data showed a 6.5% increase in prices over the 12 months to the end of December, down from 7.1% in November. The movement was largely driven by sharp falls in energy prices, in particular petrol. While President Biden celebrated the result, stating that ‘we are clearly moving in the right direction’, analysts caution that there is still a rough road ahead. While energy has dropped in price, other areas of consumption, such as clothing, continue to increase.

The UK experienced positive growth in November according to data released on Friday by the ONS, with the economy expanding 0.1% despite a bleak overall picture for the UK Economy. As a result, a technical recession (two consecutive quarters of negative growth) has been averted for now but many of the factors driving the current economic outlook remain. The largest contributors to growth were food and beverage services in the month where the World Cup started.

The FTSE 100 fell just short of hitting some all-time highs on Friday after a strong start to the year, with unexpected GDP growth providing a welcome boost to the market. Investors are also eyeing the fact that US inflation in aggregate has continued to weaken; the hopes for the Fed to maintain if not downgrade its current rate hike cycle have sent positive ripples throughout the wider Eurozone. The index closed at 7,844.07 on Friday, fast approaching its peak close of 7877.45 back in May 2018.

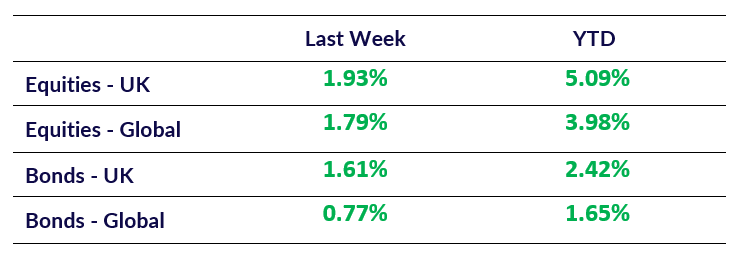

Market Pulse

Coming Up

- UK CPI data (YoY Dec) released 18th January, forecasted at 10.5%

- EU CPI data (YoY Dec) released 18th January, forecasted at 9.2%

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel