The infoshot to help kick-start your week

Last Week

The UK narrowly avoided tumbling into recession in 2022, new data shows, after the economy saw zero growth from October through December. This is despite a sharp 0.5% fall in economic output during December, in part due to a rough period of strikes. Chancellor Hunt said the figures show an ‘underlying resilience’, but the BoE still expects the country to enter a recession this year. They remain slightly more optimistic on its severity and duration, however.

The Fed’s Waller spoke on Wednesday regarding the US inflation battle, warning that the fight is not over, and rates could end up higher than markets are anticipating. His statement comes after the ‘robust’ January jobs report, showing nonfarm payroll growth of 517,000. The added fuel to consumer spending is likely to maintain upward pressure on inflation. Consequently, he emphasised the need for the Fed to maintain its current plan of action.

Europe’s spend on the energy crisis, to shield households and companies from rising energy costs has climbed to nearly 800 billion euros since September 2021, according to analysis by the think-tank Bruegel. The data makes it evident the importance of countries to be more focused in their spending to tackle the energy crisis. The EU have allocated around 680 billion, with the non-EU UK and Norway contributing 110 billion to the total.

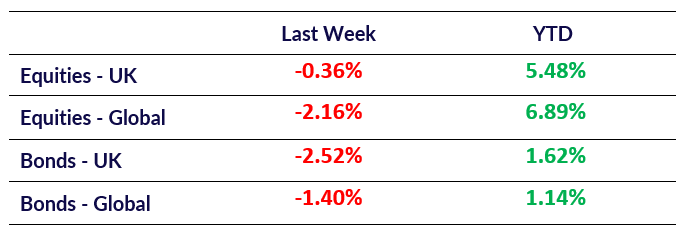

Market Pulse

Coming Up

- US CPI (JAN YoY) data released February 14th, 2:30pm.

- UK CPI (JAN YoY) data released February 15th, 8:00am.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel