The infoshot to help kick-start your week

Last Week

In a historic move, the BoE has started to unwind the key emergency support it brought in after the 2008 financial crisis, as it reverses quantitative easing. The bank sold off a tranche of government bonds on Tuesday, a sum of £750 million. While the amount is small relative to the total (over £838bn), the MPC’s Andrew Sentance states ‘We don’t quite know what the impact is going to be on bond markets, so it makes sense to proceed cautiously.’ The bank aims to reduce its holdings by £80bn by next September.

On Wednesday the Fed, raised its short-term borrowing rate by 0.75 percentage point to a target range of 3.75%-4%, the highest level since January 2008. While stocks rose initially following the announcement, they turned negative following Powell’s news conference, as markets tried to gauge whether the Fed thinks it can implement a less restrictive policy that would include a slower pace of rate hikes to achieve its inflation goals. Notably, Powell stated that the ‘the ultimate level of interest rates will be higher than previously expected’.

The BoE raised interest rates from 2.25% to 3%, the largest single jump since 1989. It also updated its expectations for the length and severity of the recession, warning that the UK would face a ‘very challenging’ two year slump, with unemployment likely doubling by 2025 to nearly 6.5%. While the recession is not projected to be the deepest downturn, it will likely be the longest since records began in 1920, the BoE states.

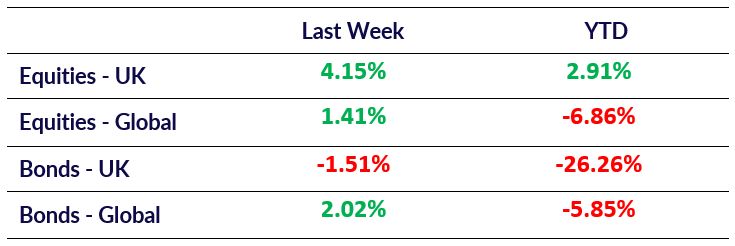

Market Pulse

Coming Up

- US Consumer Price Index (YoY Oct) released November 10th, predicted to be 8.0%.

- UK GDP (YoY Q3) released November 11th, predicted to be 2.1%.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel