![]()

![]() US Tech stocks drop by 5% on worries about increased regulation scrutiny of personal data use and the prospect of a US-China trade war.

US Tech stocks drop by 5% on worries about increased regulation scrutiny of personal data use and the prospect of a US-China trade war.

![]() Nissan and Renault are in talks to merge to create one large automaker causing Renault shares to surge more than 8.3%.

Nissan and Renault are in talks to merge to create one large automaker causing Renault shares to surge more than 8.3%.

![]() North Korean leader Kim Jong Un paid a surprise visit to China, meeting President Xi Jinping, and expressed his willingness to meet with US President Trump to discuss terms on de-nuclearisation of North Korea.

North Korean leader Kim Jong Un paid a surprise visit to China, meeting President Xi Jinping, and expressed his willingness to meet with US President Trump to discuss terms on de-nuclearisation of North Korea.

![]() The UK now has one year to agree a Brexit deal and put an implementation plan in place for the post-Brexit transition period. The Bank of England is reassuring financial institutions that the transition period would ease their preparations for Brexit, while the European regulators continue to pressure financial institutions to stay prepared for a hard Brexit.

The UK now has one year to agree a Brexit deal and put an implementation plan in place for the post-Brexit transition period. The Bank of England is reassuring financial institutions that the transition period would ease their preparations for Brexit, while the European regulators continue to pressure financial institutions to stay prepared for a hard Brexit.

![]()

![]()

![]() On Wednesday April 4, US Services PMI data for March will be released and is expected to be 54.1 vs. 55.9 for February.

On Wednesday April 4, US Services PMI data for March will be released and is expected to be 54.1 vs. 55.9 for February.

![]() US non-farm payrolls are set to be released on Friday April 6, which is expected to come in at 203K, with the unemployment rate set to drop to 4% lowest in over a decade.

US non-farm payrolls are set to be released on Friday April 6, which is expected to come in at 203K, with the unemployment rate set to drop to 4% lowest in over a decade.

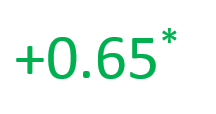

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 28/02/18

Notice:

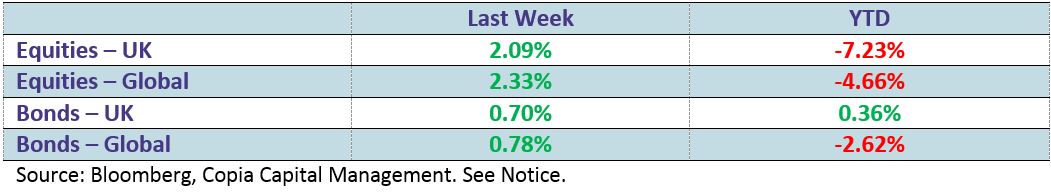

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.