![]()

![]() On Tuesday August 25, Alibaba’s affiliate, Ant Financial Services Group, filed for IPO on Hong Kong and Shanghai stock markets, targeting a $30 billion IPO and a market valuation of $225 billion.

On Tuesday August 25, Alibaba’s affiliate, Ant Financial Services Group, filed for IPO on Hong Kong and Shanghai stock markets, targeting a $30 billion IPO and a market valuation of $225 billion.

![]() On Tuesday, Chief Economist Philip Lane confirmed that the ECB remains committed to providing the monetary stimulus to support the economic recovery if needed, and the pandemic emergency purchase program (PEPP) will stay in place at least until June 2021. UK Health Secretary Matt Hancock revealed on Thursday that the government will launch a new payment scheme in September, which will pay up to £182 to people with low incomes and unable to work from home due to Covid infections or the 14-day self-isolation.

On Tuesday, Chief Economist Philip Lane confirmed that the ECB remains committed to providing the monetary stimulus to support the economic recovery if needed, and the pandemic emergency purchase program (PEPP) will stay in place at least until June 2021. UK Health Secretary Matt Hancock revealed on Thursday that the government will launch a new payment scheme in September, which will pay up to £182 to people with low incomes and unable to work from home due to Covid infections or the 14-day self-isolation.

![]() On Thursday August 27, the US Fed released a new monetary policy statement, making a change of the inflation target to an average of 2% over time from a fixed 2% inflation goal. This policy shift allows the bank to keep a lower interest rates for longer given the current weak economic growth expectation and high unemployment in the US.

On Thursday August 27, the US Fed released a new monetary policy statement, making a change of the inflation target to an average of 2% over time from a fixed 2% inflation goal. This policy shift allows the bank to keep a lower interest rates for longer given the current weak economic growth expectation and high unemployment in the US.

![]() Japan’s Prime Minister Shinzo Abe announced on Friday August 28 that he will resign from his post due to his deteriorating health, but will remain in his position until his ruling Liberal Democratic Party holds a leadership election.

Japan’s Prime Minister Shinzo Abe announced on Friday August 28 that he will resign from his post due to his deteriorating health, but will remain in his position until his ruling Liberal Democratic Party holds a leadership election.

![]()

![]()

![]() Eurozone CPI will be announced on Tuesday September 1, with an expectation of 0.2% YoY.

Eurozone CPI will be announced on Tuesday September 1, with an expectation of 0.2% YoY.

![]() US will publish the change in Nonfarm payrolls for August on Friday September 4, which is expected at 1,486K.

US will publish the change in Nonfarm payrolls for August on Friday September 4, which is expected at 1,486K.

![]()

-0.40*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/08/20

Notice:

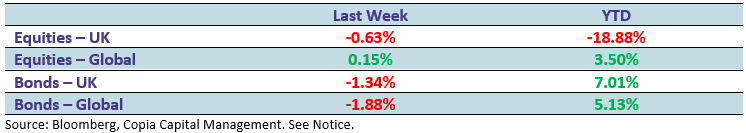

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.