![]()

![]() On Friday August 23, China announced it will impose new tariffs up to 10% on $75 Billion on goods imported from the US as the trade war between US and China escalated. Surprisingly, equity markets had a very subdued reaction to the announcement.

On Friday August 23, China announced it will impose new tariffs up to 10% on $75 Billion on goods imported from the US as the trade war between US and China escalated. Surprisingly, equity markets had a very subdued reaction to the announcement.

![]() Prime Minister Boris Johnson met with German Chancellor Angela Merkel and French President Emmanuel Macron for Brexit talk. The EU continues to take a stand that the withdrawal deal negotiated earlier is not open for re-negotiation.

Prime Minister Boris Johnson met with German Chancellor Angela Merkel and French President Emmanuel Macron for Brexit talk. The EU continues to take a stand that the withdrawal deal negotiated earlier is not open for re-negotiation.

![]() The US Fed officials met at Jackson Hole where the US Fed Chairman Jerome Powell mentioned the US economy is in a ‘favourable’ place and that the Fed will ‘act as appropriate’, signalling a potential rate cut as the escalating trade war with China poses a potential risk of a US slowdown.

The US Fed officials met at Jackson Hole where the US Fed Chairman Jerome Powell mentioned the US economy is in a ‘favourable’ place and that the Fed will ‘act as appropriate’, signalling a potential rate cut as the escalating trade war with China poses a potential risk of a US slowdown.

![]() On Thursday August 22, Apple announced it will be launching new Camera-Focused Pro iPhones very soon. It also plans to upgrade its iPad and MacBook Pro to restart flagging sales growth.

On Thursday August 22, Apple announced it will be launching new Camera-Focused Pro iPhones very soon. It also plans to upgrade its iPad and MacBook Pro to restart flagging sales growth.

![]()

![]()

![]() US GDP growth will be announced on Thursday August 29, with an expectation of 2% YoY.

US GDP growth will be announced on Thursday August 29, with an expectation of 2% YoY.

![]() Also on Thursday August 29, Japan Consumer confidence will be announced with an expectation of 37.8.

Also on Thursday August 29, Japan Consumer confidence will be announced with an expectation of 37.8.

![]()

+0.49*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/07/19

Notice:

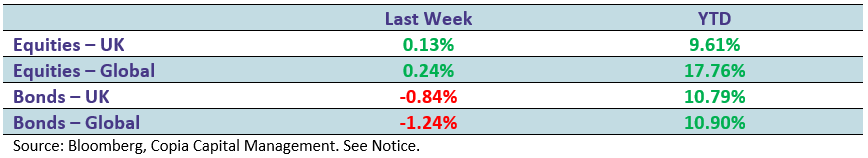

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.