![]()

![]() Turkey’s central bank increased the late liquidity window rate by 3% to 16.5% at an emergency meeting while keeping other rates unchanged. This was a strong monetary tightening move to support its currency the Lira, which previously slid 5.5% against dollar.

Turkey’s central bank increased the late liquidity window rate by 3% to 16.5% at an emergency meeting while keeping other rates unchanged. This was a strong monetary tightening move to support its currency the Lira, which previously slid 5.5% against dollar.

![]() China announced that it will reduce the tariffs on imported cars from 25% to 15% and lower the levy on imported auto parts to 6% from 1 July 2018.

China announced that it will reduce the tariffs on imported cars from 25% to 15% and lower the levy on imported auto parts to 6% from 1 July 2018.

![]() The minutes of the Federal Reserve meeting in May suggested that an interest rate “modestly” above 2% is tolerable and signalled the next hike is likely to take place in June, keeping on track with the Fed’s symmetric inflation objective of 2%.

The minutes of the Federal Reserve meeting in May suggested that an interest rate “modestly” above 2% is tolerable and signalled the next hike is likely to take place in June, keeping on track with the Fed’s symmetric inflation objective of 2%.

![]()

![]()

![]() US GDP growth will be released on Wednesday May 30, at an expected rate of 2.3% QoQ.

US GDP growth will be released on Wednesday May 30, at an expected rate of 2.3% QoQ.

![]() US unemployment rate will be released on Friday June 1 and is expected at 3.9%.

US unemployment rate will be released on Friday June 1 and is expected at 3.9%.

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 21/05/18

Notice:

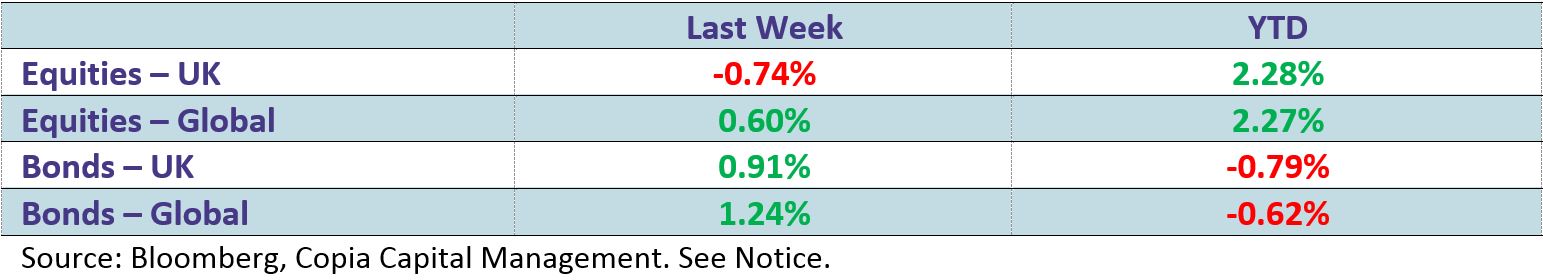

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.