![]()

![]() The Fed decided to leave the interest rate unchanged at the FOMC meeting while noting that inflation over next the twelve months should “run near” the 2% target. The next rate hike is expected to take place at the policy meeting in June.

The Fed decided to leave the interest rate unchanged at the FOMC meeting while noting that inflation over next the twelve months should “run near” the 2% target. The next rate hike is expected to take place at the policy meeting in June.

![]() Apple reported its quarterly numbers with the revenue growing 16% YoY for the quarter ending March 2018, which has been driven by the higher price of iPhone X, charges for premium services as well as increasing sales of cheaper iPhone models.

Apple reported its quarterly numbers with the revenue growing 16% YoY for the quarter ending March 2018, which has been driven by the higher price of iPhone X, charges for premium services as well as increasing sales of cheaper iPhone models.

![]() Sainsbury and Asda confirmed their £12bn merger. Both supermarkets plan to cut grocery prices after the merger without store closures.

Sainsbury and Asda confirmed their £12bn merger. Both supermarkets plan to cut grocery prices after the merger without store closures.

![]()

![]()

![]() The US CPI will be released on Thursday May 10 and is expected to come in at 2.5% YoY.

The US CPI will be released on Thursday May 10 and is expected to come in at 2.5% YoY.

![]() On the same day, Thursday May 10, the UK will report the Balance of Trade, with the deficit expected to widen to £2bn in March.

On the same day, Thursday May 10, the UK will report the Balance of Trade, with the deficit expected to widen to £2bn in March.

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/04/18

Notice:

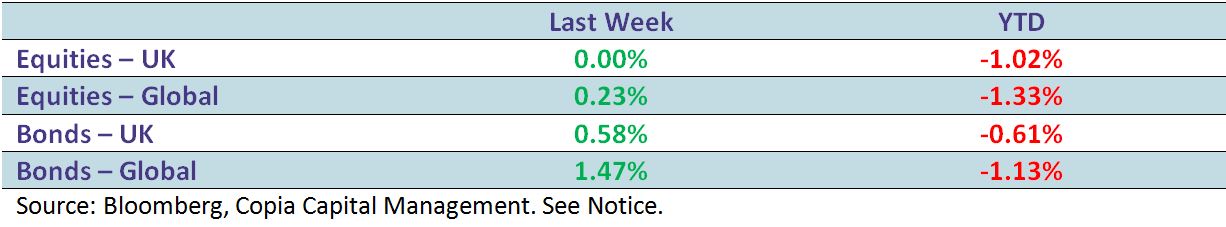

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.