At Copia we believe that the art of investment portfolio construction lies in the raw science that underpins asset selection. We take a systematic approach to constructing portfolios for our clients, drawing on the scientific investment models used by the world’s most experienced and successful investors. We also have a rigorous approach to demonstrating value for money and you can read more about our assessment process here.

Effective asset allocation is ultimately the main driver of portfolio outcomes and Copia’s systematic approach to asset allocation is guided by our proprietary Risk Barometer. This ensures we can fully appreciate the potential impacts of market fluctuations and macroeconomic conditions to carefully balance the risks against potential rewards. Copia portfolios are constructed using a combination of ETFs, Index Funds and Actively Managed Funds and managed professionally using quantitative tools for risk management. Your clients will always get the highest possible transparency, diversification and risk control.

The objectives behind every investment will vary hugely according to each of your client’s stage in the investment lifecycle and their individual attitudes to risk. To cater to the broadest possible range of your clients’ requirements Copia offers a variety of purpose-built portfolios, each of which has been designed with very specific objectives in mind. And just as each investment portfolio is unique, so too are the management strategies we adopt. All designed to help you meet your clients’ specific needs.

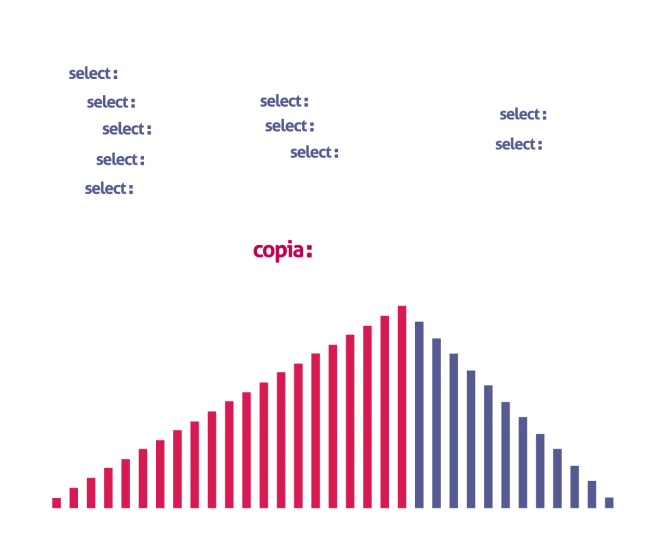

Our portfolios are grouped by the three principal client needs over the investment lifecycle: wealth accumulation, wealth preservation and decumulation.

Copia offers a suite of accumulation portfolios which are designed to grow and preserve capital over the medium-to-long term.

Our wealth preservation portfolios are designed to deliver real returns, whilst limiting the impact of downside risk over a medium to long term timeframe.

Our portfolios for decumulation are designed for your clients wanting a purpose-built income portfolio as part of their broader retirement plan and would be suitable for those approaching or in the retirement phase of their investment lifecycle.

Copia Client Categorisation

Copia treats all actual and potential MPS investor clients as Retail customers.

Whilst all Copia’s MPS portfolios are managed to deliver value for money, the mandates to manage model portfolios for those Retail investor clients do vary, between Copia’s off the shelf models, and those customised for specific adviser firm’s target markets.

Copia’s Custom product mandates are managed under Agent of Client (aka Reliance on Others), where Copia treats the Adviser firm as the agent of the investor client and relies on them for information on the client. Under these arrangements, often referred to as tripartite, there is a direct contractual relationship between Copia and the investor client. This means that should it be required, direct access to the Financial Ombudsman Service (FOS) is available to that investor as a direct client of Copia.

Off the shelf products are managed under an Agent as Client contractual basis, where for all practical information and instruction purposes treats the Adviser firm as the client. Under this arrangement there is no contractual relationship between Copia and the investor client. The contractual relationship here is only between Copia and the Adviser firm (and between adviser firm and investor client), but it still allows the adviser firm to make suitable investment decisions on the investor client’s behalf. However, without that direct contractual relationship between Copia and the investor client, there is no access to the Financial Ombudsman Service through Copia.

This information is intended for professional financial advisers only. Copia does not provide financial advice. This information is not intended as financial advice and should not be interpreted as such. Model investment portfolios may not be suitable for everyone. The value of funds can increase and decrease, past performance and historical data cannot guarantee future success. Investors may get back less than they originally invested.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

I work for an advisory / professional firm or other eligible counterparty.

I will take responsibility for any jurisdictional restrictions that apply to the services described by this website in accordance with applicable law and regulation.

I have read and accept that Cookies are used on this website. I understand that a Cookie will show that I have accepted the terms to access this website.

I confirm that I am resident in the UK or other EU Country and I am not a US citizen.

I have read and accept that Cookies are used on this website. I understand that a Cookie will show that I have accepted the terms to access this website.

The content of this website may only be viewed by persons that meet either of the above conditions. If neither option is applicable please click here which will close this webpage.

Error: Contact form not found.