![]()

![]() Both US and China signalled that the trade negotiation over phase one trade deal was near completion with two sides reaching consensus on how to resolve remaining issues over a phone call on Monday November 25.

Both US and China signalled that the trade negotiation over phase one trade deal was near completion with two sides reaching consensus on how to resolve remaining issues over a phone call on Monday November 25.

![]() Also on Monday, the luxury goods conglomerate LVMH announced its acquisition of the luxury jewellery company Tiffany & Co. at the price of $16.2 billion or $135 per share, marking the largest takeover in luxury good sector.

Also on Monday, the luxury goods conglomerate LVMH announced its acquisition of the luxury jewellery company Tiffany & Co. at the price of $16.2 billion or $135 per share, marking the largest takeover in luxury good sector.

![]() On Wednesday November 27, Trump signed the bill to officially support Hong Kong protestors in spite of clear objections from China. Trade worries rose again as China claimed it will retaliate.

On Wednesday November 27, Trump signed the bill to officially support Hong Kong protestors in spite of clear objections from China. Trade worries rose again as China claimed it will retaliate.

![]() On Friday November 29, the Eurozone unemployment rate was published showing a decline to 7.5% in October from 7.6% in September, the lowest level since July 2008.

On Friday November 29, the Eurozone unemployment rate was published showing a decline to 7.5% in October from 7.6% in September, the lowest level since July 2008.

![]()

![]()

![]() US trade balance for October will be announced on Thursday December 5, with an expected deficit at $48.8bn.

US trade balance for October will be announced on Thursday December 5, with an expected deficit at $48.8bn.

![]() US unemployment rate will be released on Friday December 6 and is expected at 3.6%.

US unemployment rate will be released on Friday December 6 and is expected at 3.6%.

![]()

+0.54*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 26/11/19

Notice:

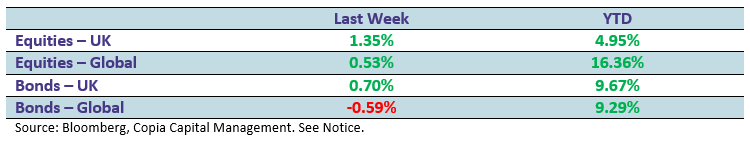

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.