![]()

![]() Over last week, the trade development between the US and China made further progress. The US started giving licenses back to companies to do business with Huawei and Chinese President Xi said China is keen to reach a trade deal with the US but is not afraid of the trade war.

Over last week, the trade development between the US and China made further progress. The US started giving licenses back to companies to do business with Huawei and Chinese President Xi said China is keen to reach a trade deal with the US but is not afraid of the trade war.

![]() On Wednesday November 20, a bill was approved by the US Senate and House of Representatives to support Hong Kong protestors by placing annual reviews on Hong Kong’s trade status as a separate trading entity and will become official law if signed by Trump.

On Wednesday November 20, a bill was approved by the US Senate and House of Representatives to support Hong Kong protestors by placing annual reviews on Hong Kong’s trade status as a separate trading entity and will become official law if signed by Trump.

![]() On Thursday November 21, the Organisation for Economic Co-operation and Development (OECD) published a report, revising down the global growth forecast again for 2020 from 3.0% in September to 2.9%, marking the lowest growth rate since 2008 financial crisis.

On Thursday November 21, the Organisation for Economic Co-operation and Development (OECD) published a report, revising down the global growth forecast again for 2020 from 3.0% in September to 2.9%, marking the lowest growth rate since 2008 financial crisis.

![]() As the biggest investor of WeWork, Softbank is planning a bailout to raise $2.76bn to support WeWork. Meanwhile, 2,400 WeWork employees will be laid off in an attempt to cut costs of the business.

As the biggest investor of WeWork, Softbank is planning a bailout to raise $2.76bn to support WeWork. Meanwhile, 2,400 WeWork employees will be laid off in an attempt to cut costs of the business.

![]()

![]()

![]() US GDP growth will be released on Wednesday November 27, at an expected annualised growth rate of 1.9% QoQ.

US GDP growth will be released on Wednesday November 27, at an expected annualised growth rate of 1.9% QoQ.

![]() Eurozone CPI will be announced on Friday November 29, with an expectation of 0.90% YoY.

Eurozone CPI will be announced on Friday November 29, with an expectation of 0.90% YoY.

![]()

+0.59*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 18/11/19

Notice:

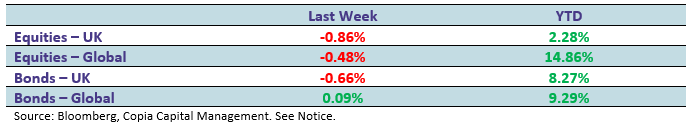

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.