![]()

![]() On Sunday November 3, Saudi Aramco, the world’s largest oil and gas company, announced that it will proceed to launch its IPO, which had previously been delayed due to the drone attacks on its facilities.

On Sunday November 3, Saudi Aramco, the world’s largest oil and gas company, announced that it will proceed to launch its IPO, which had previously been delayed due to the drone attacks on its facilities.

![]() On Thursday November 7, the BoE decided to keep the benchmark interest rate unchanged at 0.75%, given that the underlying UK GDP growth has slowed materially this year. However, it raised the GDP growth forecast for 2019 to 1.4% compared to 1.3% in August.

On Thursday November 7, the BoE decided to keep the benchmark interest rate unchanged at 0.75%, given that the underlying UK GDP growth has slowed materially this year. However, it raised the GDP growth forecast for 2019 to 1.4% compared to 1.3% in August.

![]() US and China reached an agreement on Thursday to cancel the existing tariffs imposed on each other in phases. China’s Commerce Ministry stressed that tariffs must be removed “simultaneously and proportionally” if a trade agreement is reached.

US and China reached an agreement on Thursday to cancel the existing tariffs imposed on each other in phases. China’s Commerce Ministry stressed that tariffs must be removed “simultaneously and proportionally” if a trade agreement is reached.

![]() The information technology company HP Inc. confirmed on Wednesday November 6 that it received a takeover offer from Xerox. The bid is at $22 per share in cash and stock.

The information technology company HP Inc. confirmed on Wednesday November 6 that it received a takeover offer from Xerox. The bid is at $22 per share in cash and stock.

![]()

![]()

![]() US CPI for October will be announced on Wednesday November 13, with an expectation of 1.7% YoY.

US CPI for October will be announced on Wednesday November 13, with an expectation of 1.7% YoY.

![]() On the same day, UK CPI for October will also be released, with an expectation of 1.6% YoY.

On the same day, UK CPI for October will also be released, with an expectation of 1.6% YoY.

![]()

+0.56*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/10/19

Notice:

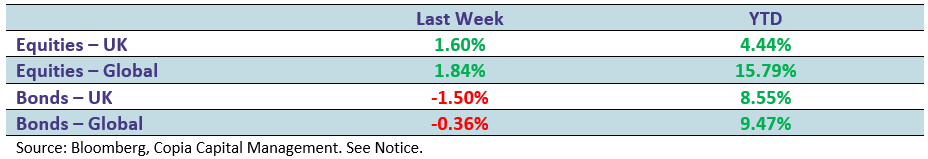

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.