![]()

![]() Last week, the UK Prime Minister formally requested the EU for an extension of the October 31 Brexit deadline in order to be lawfully compliant with the Benn Act. The EU is delaying its decision on the length of the next Brexit extension.

Last week, the UK Prime Minister formally requested the EU for an extension of the October 31 Brexit deadline in order to be lawfully compliant with the Benn Act. The EU is delaying its decision on the length of the next Brexit extension.

![]() On Thursday October 24, Amazon reported its profit decline in two years as its global shipping cost soared 46% in the Q3 to $9.6bn as the company offers the one-day delivery on it Prime items. Amazon shares trading at $1,712 would mean Jeff Bezos is set to lose his wealthiest man title to Bill Gates.

On Thursday October 24, Amazon reported its profit decline in two years as its global shipping cost soared 46% in the Q3 to $9.6bn as the company offers the one-day delivery on it Prime items. Amazon shares trading at $1,712 would mean Jeff Bezos is set to lose his wealthiest man title to Bill Gates.

![]() Citigroup promoted Jane Fraser to No.2 job and she is expected to succeed Michael Corbat the current CEO. Jane is set to become the first woman to lead a major US bank.

Citigroup promoted Jane Fraser to No.2 job and she is expected to succeed Michael Corbat the current CEO. Jane is set to become the first woman to lead a major US bank.

![]() On Thursday October 24, the ECB kept its interest rate unchanged at 0% and will resume its Quantitative Easing programme by 20bn euros per month from November 1.

On Thursday October 24, the ECB kept its interest rate unchanged at 0% and will resume its Quantitative Easing programme by 20bn euros per month from November 1.

![]()

![]()

![]() On October 30, analysts expect the US Fed to cut its interest rate by 25bps, taking it down to 1.75%.

On October 30, analysts expect the US Fed to cut its interest rate by 25bps, taking it down to 1.75%.

![]() On November 1, US employment data will be released. US economy is expected to have added 90,000 jobs in October 2019.

On November 1, US employment data will be released. US economy is expected to have added 90,000 jobs in October 2019.

![]()

+0.38*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 21/10/19

Notice:

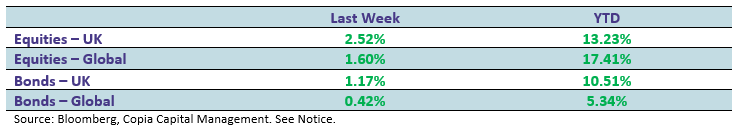

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.