![]()

![]() On Monday October 14, the UK government submitted revised Brexit proposals to the EU and on Thursday, the European Commission President Jean-Claude Juncker confirmed that a new Brexit deal had been agreed with the UK.

On Monday October 14, the UK government submitted revised Brexit proposals to the EU and on Thursday, the European Commission President Jean-Claude Juncker confirmed that a new Brexit deal had been agreed with the UK.

![]() On Tuesday October 15, JPMorgan, Citigroup and Goldman Sachs published earnings reports for the third quarter. JPMorgan’s revenue rose 8%YoY and EPS was higher than the forecast at $2.68. Citigroup saw a falling revenue of 1%YoY while the EPS improved 20%, standing at $2.07%. The Q3 earnings for Goldman Sachs missed the estimates with profits declining 26%YoY to $1.88bn.

On Tuesday October 15, JPMorgan, Citigroup and Goldman Sachs published earnings reports for the third quarter. JPMorgan’s revenue rose 8%YoY and EPS was higher than the forecast at $2.68. Citigroup saw a falling revenue of 1%YoY while the EPS improved 20%, standing at $2.07%. The Q3 earnings for Goldman Sachs missed the estimates with profits declining 26%YoY to $1.88bn.

![]() On Wednesday October 16, the US lawmakers passed a bill that suggests placing annual reviews on Hong Kong’s trade status as a separate trading entity. China warned that it will take strong countermeasures against the US if the bill becomes an effective law.

On Wednesday October 16, the US lawmakers passed a bill that suggests placing annual reviews on Hong Kong’s trade status as a separate trading entity. China warned that it will take strong countermeasures against the US if the bill becomes an effective law.

![]() On Thursday October 17, the Turkish President Recep Tayyip Erdogan agreed and announced with the US a 120-hour ceasefire in Syria so that its Kurdish allies can withdraw from the safe zone.

On Thursday October 17, the Turkish President Recep Tayyip Erdogan agreed and announced with the US a 120-hour ceasefire in Syria so that its Kurdish allies can withdraw from the safe zone.

![]()

![]()

![]() The Eurozone Manufacturing PMI will be released on Thursday October 24 and is expected to come in at 46.00.

The Eurozone Manufacturing PMI will be released on Thursday October 24 and is expected to come in at 46.00.

![]() Also on Thursday, the ECB will announce the Interest Rate Decision, which is expected to remain at 0.00%.

Also on Thursday, the ECB will announce the Interest Rate Decision, which is expected to remain at 0.00%.

![]()

+0.18*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/09/19

Notice:

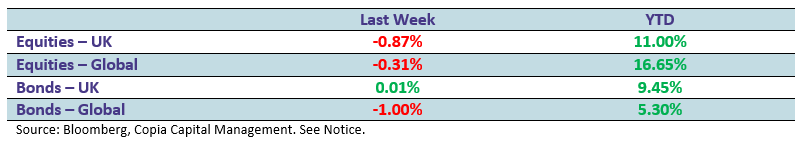

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.