![]()

![]() UK and EU Brexit talks moved to a critical stage on Friday as signs of a potential break-through have emerged. Pound Sterling rallied 4.1% over the last 2 days on hopes that a deal could be reached averting a Hard Brexit outcome on 31st October.

UK and EU Brexit talks moved to a critical stage on Friday as signs of a potential break-through have emerged. Pound Sterling rallied 4.1% over the last 2 days on hopes that a deal could be reached averting a Hard Brexit outcome on 31st October.

![]() Thursday was the first day of trade talks between US and China after talks broke down in during July of this year. US President Trump said the talks went very well. If no progress is made during these talks, the US is due to increase tariffs on about $250 billion of Chinese imports from 25% to 30% on October 15.

Thursday was the first day of trade talks between US and China after talks broke down in during July of this year. US President Trump said the talks went very well. If no progress is made during these talks, the US is due to increase tariffs on about $250 billion of Chinese imports from 25% to 30% on October 15.

![]() Turkish troops advanced into Syria as the United States withdrew its troops from the region and stopped backing the Kurdish forces. Turkey is leading an offensive on ISIS and Kurdish forces in Syria and is threatening to send millions of refugees to Europe if EU calls the Syria offensive an ‘invasion’.

Turkish troops advanced into Syria as the United States withdrew its troops from the region and stopped backing the Kurdish forces. Turkey is leading an offensive on ISIS and Kurdish forces in Syria and is threatening to send millions of refugees to Europe if EU calls the Syria offensive an ‘invasion’.

![]() An Iranian oil tanker was hit by missiles in the Red Sea near Saudi Arabia. Oil prices mildly jumped on this news. Uncertainty in Middle East continues to escalate increasing volatility in oil markets.

An Iranian oil tanker was hit by missiles in the Red Sea near Saudi Arabia. Oil prices mildly jumped on this news. Uncertainty in Middle East continues to escalate increasing volatility in oil markets.

![]()

![]()

![]() The US Retail Sales for September will be announced on Wednesday October 16, with an expectation of 0.30% MoM.

The US Retail Sales for September will be announced on Wednesday October 16, with an expectation of 0.30% MoM.

![]() UK CPI is expected to come in at 1.8% YoY on Wednesday October 16, staying within the BOE target rate.

UK CPI is expected to come in at 1.8% YoY on Wednesday October 16, staying within the BOE target rate.

![]()

+0.18*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/09/19

Notice:

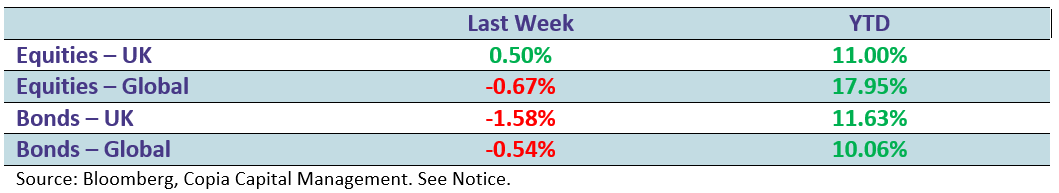

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.