![]()

![]() On Saturday September 14, two Saudi Aramco’s facilities were attacked by drones, resulting in a reduction of Saudi’s oil output by 50%. On Wednesday September 18, the US and Saudi Arabia both accused Iran of the attack.

On Saturday September 14, two Saudi Aramco’s facilities were attacked by drones, resulting in a reduction of Saudi’s oil output by 50%. On Wednesday September 18, the US and Saudi Arabia both accused Iran of the attack.

![]() On Wednesday, the US Fed announced a rate cut on its benchmark interest rate by 0.25%, taking the federal funds target range down to 1.75%-2.00%. The decision was mainly influenced by considerations including “muted inflationary pressures” and “global developments for the economic outlook”.

On Wednesday, the US Fed announced a rate cut on its benchmark interest rate by 0.25%, taking the federal funds target range down to 1.75%-2.00%. The decision was mainly influenced by considerations including “muted inflationary pressures” and “global developments for the economic outlook”.

![]() On Thursday September 19, the BoE decided to keep the benchmark interest rate unchanged at 0.75%. It warned that the possible delay of Brexit can cause further uncertainties, especially in demand growth and consumer prices would be impacted.

On Thursday September 19, the BoE decided to keep the benchmark interest rate unchanged at 0.75%. It warned that the possible delay of Brexit can cause further uncertainties, especially in demand growth and consumer prices would be impacted.

![]() Also on Thursday, the Organisation for Economic Co-operation and Development (OECD) published a report, revising down the forecast for global economic growth to the lowest level since the financial crisis in 2008. It predicts that global economy will grow at 2.9% in 2019 and 3.0% in 2020.

Also on Thursday, the Organisation for Economic Co-operation and Development (OECD) published a report, revising down the forecast for global economic growth to the lowest level since the financial crisis in 2008. It predicts that global economy will grow at 2.9% in 2019 and 3.0% in 2020.

![]()

![]()

![]() US Manufacturing PMI will be released on Monday September 23 and is expected to come in at 50.3.

US Manufacturing PMI will be released on Monday September 23 and is expected to come in at 50.3.

![]() US GDP growth will be released on Thursday September 26, at an expected annualised growth rate of 2.0% QoQ.

US GDP growth will be released on Thursday September 26, at an expected annualised growth rate of 2.0% QoQ.

![]()

+0.58*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/08/19

Notice:

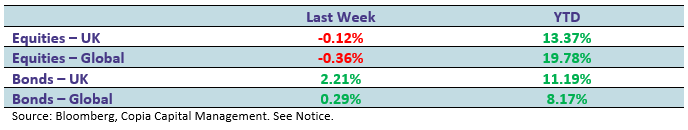

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.