![]()

![]() On Tuesday September 10, the prorogation was announced by House of Lords and the UK Parliament officially shut down for 5 weeks until October 14.

On Tuesday September 10, the prorogation was announced by House of Lords and the UK Parliament officially shut down for 5 weeks until October 14.

![]() On Thursday September 12, the European Central Bank cut the deposit rate by 10bps to -0.50% and announced another round of monetary stimulus.

On Thursday September 12, the European Central Bank cut the deposit rate by 10bps to -0.50% and announced another round of monetary stimulus.

![]() On Thursday, Trump decided to postpone the introduction of the additional 5% US tariffs imposed on $250bn of Chinese imports by 15 days. On Friday September 13, China announced some American agricultural goods that will be exempted from import tax, including soybeans and pork.

On Thursday, Trump decided to postpone the introduction of the additional 5% US tariffs imposed on $250bn of Chinese imports by 15 days. On Friday September 13, China announced some American agricultural goods that will be exempted from import tax, including soybeans and pork.

![]() Also on Thursday, the Hong Kong Stock Exchanges announced a surprise offer to buy the London Stock Exchange for £32bn. The board of directors of the LSE rejected the offer unanimously.

Also on Thursday, the Hong Kong Stock Exchanges announced a surprise offer to buy the London Stock Exchange for £32bn. The board of directors of the LSE rejected the offer unanimously.

![]()

![]()

![]() On Wednesday September 18, the US Fed will need to decide the interest rate policy. The market expects a rate cut of 25bps to 0.25%.

On Wednesday September 18, the US Fed will need to decide the interest rate policy. The market expects a rate cut of 25bps to 0.25%.

![]() Also on Wednesday, UK CPI for August will be released, with an expectation of 1.9% YoY.

Also on Wednesday, UK CPI for August will be released, with an expectation of 1.9% YoY.

![]()

+0.58*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/08/19

Notice:

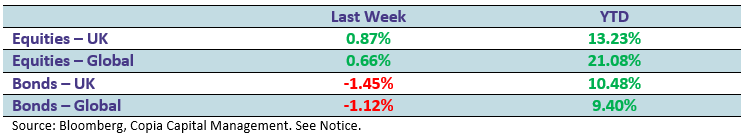

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.