![]()

![]() On Monday August 5, a sell-off in Asian, European and US equity markets was triggered by worries of the potential currency war between the US and China, after a sharp fall in Chinese yuan against US dollar to the lowest level in 11 years, with yuan traded above 7 per dollar.

On Monday August 5, a sell-off in Asian, European and US equity markets was triggered by worries of the potential currency war between the US and China, after a sharp fall in Chinese yuan against US dollar to the lowest level in 11 years, with yuan traded above 7 per dollar.

![]() On Wednesday August 7, gold surged to above $1,500 for the first time in 6 years after the equity sell-off. The demand for gold has been increasing since the beginning of 2019 due to the recession fears and low/negative yields on government bonds.

On Wednesday August 7, gold surged to above $1,500 for the first time in 6 years after the equity sell-off. The demand for gold has been increasing since the beginning of 2019 due to the recession fears and low/negative yields on government bonds.

![]() On Friday August 9, UK GDP data for Q2 2019 was published, showing a contraction of 0.2% compared to the first quarter, with the industrial production for the same period also declining by 1.4% QoQ.

On Friday August 9, UK GDP data for Q2 2019 was published, showing a contraction of 0.2% compared to the first quarter, with the industrial production for the same period also declining by 1.4% QoQ.

![]() Uber’s stock price plunged over 10% on Friday after the company reporting a net loss of $5.24bn in Q2, 496% higher than the same period last year, marking the largest loss since its financial disclosure from 2017.

Uber’s stock price plunged over 10% on Friday after the company reporting a net loss of $5.24bn in Q2, 496% higher than the same period last year, marking the largest loss since its financial disclosure from 2017.

![]()

![]()

![]() US CPI for July will be announced on Tuesday August 13, with an expectation of 1.7% YoY.

US CPI for July will be announced on Tuesday August 13, with an expectation of 1.7% YoY.

![]() On Wednesday August 14, UK CPI for July will also be released, with an expectation of 1.9% YoY.

On Wednesday August 14, UK CPI for July will also be released, with an expectation of 1.9% YoY.

![]()

+0.49*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/07/19

Notice:

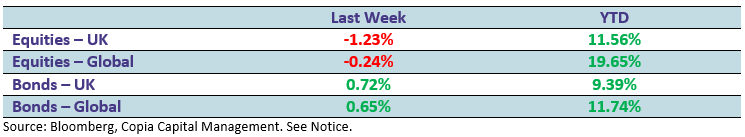

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.