![]()

![]() On Tuesday July 23, Boris Johnson, the former Foreign Secretary of the UK, was announced the new UK prime minister, beating Jeremy Hunt by winning 92,453 votes from the Conservative Party’s members.

On Tuesday July 23, Boris Johnson, the former Foreign Secretary of the UK, was announced the new UK prime minister, beating Jeremy Hunt by winning 92,453 votes from the Conservative Party’s members.

![]() On Wednesday July, 24, Tesla announced that its Chief Technology Officer JB Straubel will step down from his position, replaced by Drew Baglino. Before the news, Tesla reported its Q2 earnings, with the loss per share standing at $1.12, worse than $0.40 as expected. The share price of Tesla plunged nearly 14% on the same day.

On Wednesday July, 24, Tesla announced that its Chief Technology Officer JB Straubel will step down from his position, replaced by Drew Baglino. Before the news, Tesla reported its Q2 earnings, with the loss per share standing at $1.12, worse than $0.40 as expected. The share price of Tesla plunged nearly 14% on the same day.

![]() On Thursday July 25, the European Central Bank decided to keep its key interest rates “at their present or lower levels” at least until the end of first half of 2020. The benchmark interest rate will stay at 0%, the base deposit rate at -0.4%.

On Thursday July 25, the European Central Bank decided to keep its key interest rates “at their present or lower levels” at least until the end of first half of 2020. The benchmark interest rate will stay at 0%, the base deposit rate at -0.4%.

![]() Facebook, Amazon and Alphabet published Q2 earnings reports during last week. Facebook’s revenue increased by 28%YoY to $16.9bn and EPS was higher than the forecast at $1.99. Alphabet saw a 19%YoY increase in revenue to 38.9bn and EPS rose to $14.21 from $11.75 in Q2 2018. The revenue for Amazon in Q2 was $63.4bn, 20% higher than a year ago and EPS was 3% higher at $5.22.

Facebook, Amazon and Alphabet published Q2 earnings reports during last week. Facebook’s revenue increased by 28%YoY to $16.9bn and EPS was higher than the forecast at $1.99. Alphabet saw a 19%YoY increase in revenue to 38.9bn and EPS rose to $14.21 from $11.75 in Q2 2018. The revenue for Amazon in Q2 was $63.4bn, 20% higher than a year ago and EPS was 3% higher at $5.22.

![]()

![]()

![]() China Manufacturing PMI will be released on Wednesday July 31 and is expected to come in at 49.6.

China Manufacturing PMI will be released on Wednesday July 31 and is expected to come in at 49.6.

![]() US unemployment rate will be released on Friday August 2 and is expected at 3.7%.

US unemployment rate will be released on Friday August 2 and is expected at 3.7%.

![]()

+0.26*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 15/07/19

Notice:

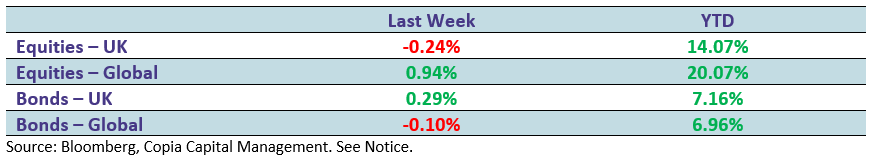

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.