![]()

![]() On Saturday June 29, the US and China reached a trade truce in the G20 summit. However, China expressed that no trade deal will be agreed unless all currently imposed tariffs are removed.

On Saturday June 29, the US and China reached a trade truce in the G20 summit. However, China expressed that no trade deal will be agreed unless all currently imposed tariffs are removed.

![]() On Monday July 1, the OPEC announced that the oil production cut will be extended by 9 months and the non-OPEC producers including Russia agreed on the cut extension as the demand is low in the oil market.

On Monday July 1, the OPEC announced that the oil production cut will be extended by 9 months and the non-OPEC producers including Russia agreed on the cut extension as the demand is low in the oil market.

![]() Wednesday July 3, China Composite PMI was released, sliding to 53.0 in June from 53.3 in May, with both the Manufacturing PMI and Service PMI declining. Meanwhile, the UK manufacturing sector also showed a contraction in June with the Manufacturing PMI dropping to the 76-month low of 48.0.

Wednesday July 3, China Composite PMI was released, sliding to 53.0 in June from 53.3 in May, with both the Manufacturing PMI and Service PMI declining. Meanwhile, the UK manufacturing sector also showed a contraction in June with the Manufacturing PMI dropping to the 76-month low of 48.0.

![]() On Friday July 5, the US nonfarm payrolls were published showing an increase of 224,000 in June, exceeding the expectation. The strong job data pushed the 10-year Treasury yield above 2.00%.

On Friday July 5, the US nonfarm payrolls were published showing an increase of 224,000 in June, exceeding the expectation. The strong job data pushed the 10-year Treasury yield above 2.00%.

![]()

![]()

![]() On Wednesday July 10, China CPI for June will be published with an expectation of a 2.7% increase YoY.

On Wednesday July 10, China CPI for June will be published with an expectation of a 2.7% increase YoY.

![]() US CPI for June will be announced on Thursday July 11, with an expectation of 1.6% YoY.

US CPI for June will be announced on Thursday July 11, with an expectation of 1.6% YoY.

![]()

+0.33*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 01/07/19

Notice:

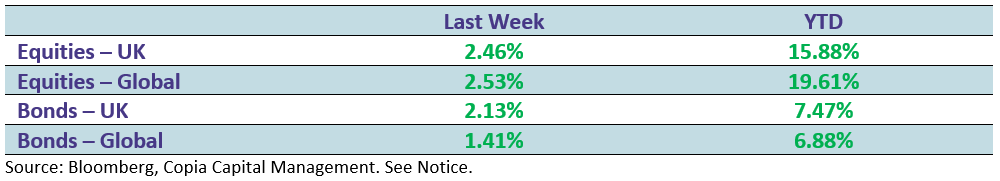

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.