![]()

![]() On Wednesday June 19, the US Fed announced to hold the current federal funds rate of 2.25%-2.5% and signalled that there will be no rate cut for this year. The central bank’s statement lowered the estimate of the US headline inflation for 2019 to 1.5% from the March forecast of 1.8% and described that the US economy is “rising at a moderate rate”.

On Wednesday June 19, the US Fed announced to hold the current federal funds rate of 2.25%-2.5% and signalled that there will be no rate cut for this year. The central bank’s statement lowered the estimate of the US headline inflation for 2019 to 1.5% from the March forecast of 1.8% and described that the US economy is “rising at a moderate rate”.

![]() On Thursday June 20, the BoE decided to keep the benchmark interest rate unchanged at 0.75% and cut the economic growth forecast to zero for the second quarter due to the increased downside risks.

On Thursday June 20, the BoE decided to keep the benchmark interest rate unchanged at 0.75% and cut the economic growth forecast to zero for the second quarter due to the increased downside risks.

![]() On Friday June 21, Gold price surged to the highest level since September 2013, hitting $1,400 per ounce as the geopolitical tension increased following the incident that Iran shot down a US drone.

On Friday June 21, Gold price surged to the highest level since September 2013, hitting $1,400 per ounce as the geopolitical tension increased following the incident that Iran shot down a US drone.

![]() On Friday, negative yielding debt from all around the world touched an all-time high of $13 trillion, indicating the heightened investors’ risk averse sentiment.

On Friday, negative yielding debt from all around the world touched an all-time high of $13 trillion, indicating the heightened investors’ risk averse sentiment.

![]()

![]()

![]() US GDP growth will be released on Thursday June 27, at an expected annualised growth rate of 3.2% QoQ.

US GDP growth will be released on Thursday June 27, at an expected annualised growth rate of 3.2% QoQ.

![]() On Friday June 28, UK GDP growth will be released and is expected to come in at 1.8% YoY.

On Friday June 28, UK GDP growth will be released and is expected to come in at 1.8% YoY.

![]()

+0.56*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 27/05/19

Notice:

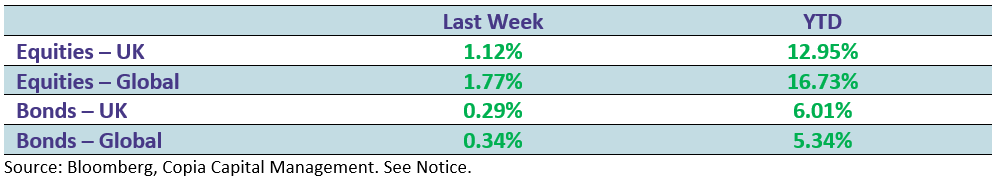

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.