![]()

![]() Two oil tankers were attacked in the Persian Gulf, leading to a spike in Oil price on Thursday, 13 June. The US is holding Iran responsible for the attacks as tensions are at an all-time high for a military conflict between the two nations.

Two oil tankers were attacked in the Persian Gulf, leading to a spike in Oil price on Thursday, 13 June. The US is holding Iran responsible for the attacks as tensions are at an all-time high for a military conflict between the two nations.

![]() US 10 year bond yields remained at a 2 year low of 2% as investors rushed for safe haven assets. Concerns about a sluggish US economy are at its highest and the US Fed is expected to cut rates. Gold touched a multi-year high of $1,350/oz.

US 10 year bond yields remained at a 2 year low of 2% as investors rushed for safe haven assets. Concerns about a sluggish US economy are at its highest and the US Fed is expected to cut rates. Gold touched a multi-year high of $1,350/oz.

![]() The race for the next UK Prime Minister heats up as Boris Johnson emerges as the frontrunner to replace Theresa May. Boris Johnson has known to take a harder stance to Brexit than the outgoing Prime Minister, stoking concerns about a hard Brexit.

The race for the next UK Prime Minister heats up as Boris Johnson emerges as the frontrunner to replace Theresa May. Boris Johnson has known to take a harder stance to Brexit than the outgoing Prime Minister, stoking concerns about a hard Brexit.

![]() On Friday 14 June, US Retail Sales were announced which showed a monthly increase of 0.5% in May, higher than street estimates, as investors debate the outlook for the US economy and potential Fed rate cuts.

On Friday 14 June, US Retail Sales were announced which showed a monthly increase of 0.5% in May, higher than street estimates, as investors debate the outlook for the US economy and potential Fed rate cuts.

![]()

![]()

![]() US Fed to announce its interest rate decision on 19th June, with an expectation of no change. Fed Funds rate is expected to remain at 2.5%.

US Fed to announce its interest rate decision on 19th June, with an expectation of no change. Fed Funds rate is expected to remain at 2.5%.

![]() Also on 19th of June, UK CPI data will be published with an expectation of a 2.0% increase YoY.

Also on 19th of June, UK CPI data will be published with an expectation of a 2.0% increase YoY.

![]()

0.56*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/05/19

Notice:

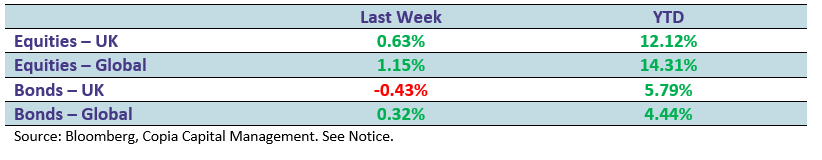

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.