![]()

![]() On Friday May 31, Trump announced that the US will impose a 5% tariff on all imports from Mexico, starting from June 10, and expressed that the tariff will be raised by 5% every month until October if the illegal immigration from Mexico persists.

On Friday May 31, Trump announced that the US will impose a 5% tariff on all imports from Mexico, starting from June 10, and expressed that the tariff will be raised by 5% every month until October if the illegal immigration from Mexico persists.

![]() On Friday, China manufacturing PMI for May was released, down by 0.7 compared to April, standing at 49.4, reflecting the decreasing market demand, especially from the overseas market. The non-manufacturing PMI remained at 54.3, unchanged from previous four consecutive months.

On Friday, China manufacturing PMI for May was released, down by 0.7 compared to April, standing at 49.4, reflecting the decreasing market demand, especially from the overseas market. The non-manufacturing PMI remained at 54.3, unchanged from previous four consecutive months.

![]() Also on Friday, the Ministry of Commerce of China made an official statement that it will set up a list of foreign companies as “unreliable entities”, which in many ways severely damage the interests of Chinese companies. Necessary measures will be taken against the firms on the list.

Also on Friday, the Ministry of Commerce of China made an official statement that it will set up a list of foreign companies as “unreliable entities”, which in many ways severely damage the interests of Chinese companies. Necessary measures will be taken against the firms on the list.

![]() With trade tensions escalating, US Treasury yields fell steeply on Friday due to investor risk aversion. German 10-year bond yield also dropped sharply to a historical low of negative 0.209%.

With trade tensions escalating, US Treasury yields fell steeply on Friday due to investor risk aversion. German 10-year bond yield also dropped sharply to a historical low of negative 0.209%.

![]()

![]()

![]() US trade balance for April will be announced on Thursday June 6, with an expected deficit at $50.7bn.

US trade balance for April will be announced on Thursday June 6, with an expected deficit at $50.7bn.

![]() US unemployment rate will be released on Friday June 7 and is expected at 3.6%.

US unemployment rate will be released on Friday June 7 and is expected at 3.6%.

![]()

+0.56*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 27/05/19

Notice:

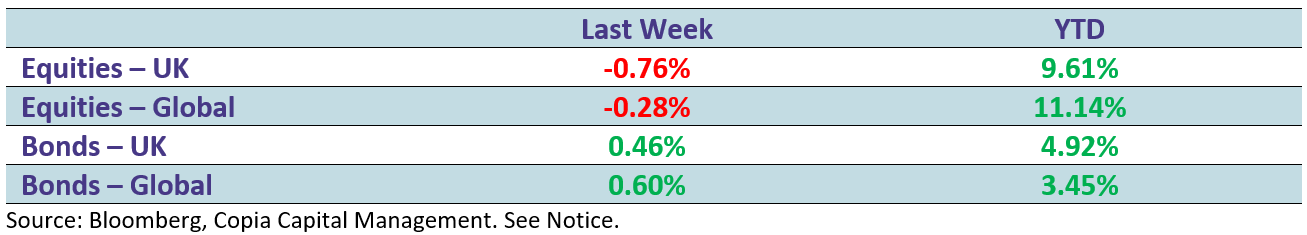

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.