![]()

![]() On Wednesday May 15, the Chinese e-commerce company Alibaba Group reported its revenue for Q1 2019, which increased by 51% compared to the same quarter last year while profit more than tripled during the same period.

On Wednesday May 15, the Chinese e-commerce company Alibaba Group reported its revenue for Q1 2019, which increased by 51% compared to the same quarter last year while profit more than tripled during the same period.

![]() On Tuesday May 14, Theresa May decided to bring her withdrawal agreement with the EU on Brexit into the UK Law via the Withdrawal Agreement Bill and the parliament vote on the bill will begin on June 3. The Prime Minister then agreed on Thursday May 16 to set her resignation date after the vote, regardless of its outcomes.

On Tuesday May 14, Theresa May decided to bring her withdrawal agreement with the EU on Brexit into the UK Law via the Withdrawal Agreement Bill and the parliament vote on the bill will begin on June 3. The Prime Minister then agreed on Thursday May 16 to set her resignation date after the vote, regardless of its outcomes.

![]() On Thursday, the US Commerce Department announced that the ban against foreign companies developing 5G networks in the US will take effect from Friday, which tends to cut off the access of the Chinese telecommunication giant, Huawei Technologies to the US market.

On Thursday, the US Commerce Department announced that the ban against foreign companies developing 5G networks in the US will take effect from Friday, which tends to cut off the access of the Chinese telecommunication giant, Huawei Technologies to the US market.

![]() On Friday May 17, Trump announced that the tariffs imposed on imported cars to the US will be postponed for 180 days as the US is still negotiating with the EU and Japan on trade deals.

On Friday May 17, Trump announced that the tariffs imposed on imported cars to the US will be postponed for 180 days as the US is still negotiating with the EU and Japan on trade deals.

![]()

![]()

![]() The UK CPI will be released on Wednesday 22 May and is expected to come in at 2.2 % YoY.

The UK CPI will be released on Wednesday 22 May and is expected to come in at 2.2 % YoY.

![]() Eurozone Composite PMI for May will be released on Thursday 23 May and is expected to come in at 51.7.

Eurozone Composite PMI for May will be released on Thursday 23 May and is expected to come in at 51.7.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 13/05/19

Notice:

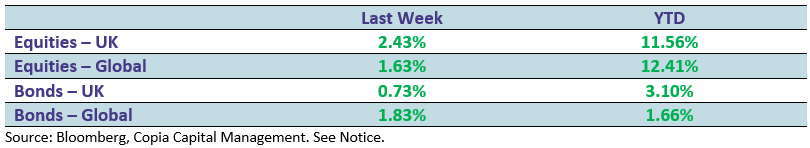

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.