![]()

![]() On Monday 22 April, the US decided not to extend the waivers on sanctions against Iranian oil exports. This means that the exemption for eight Asian countries including China, India and Japan to continue importing oil from Iran will end by 2 May. The Brent oil price jumped to a half-year high following the decision.

On Monday 22 April, the US decided not to extend the waivers on sanctions against Iranian oil exports. This means that the exemption for eight Asian countries including China, India and Japan to continue importing oil from Iran will end by 2 May. The Brent oil price jumped to a half-year high following the decision.

![]() On Thursday 25 April, Deutsche Bank and its rival Commerzbank confirmed to end the merger talks, as the combination would not have generated enough benefits to offset the additional risks and costs according to Deutsche Bank’s conclusion.

On Thursday 25 April, Deutsche Bank and its rival Commerzbank confirmed to end the merger talks, as the combination would not have generated enough benefits to offset the additional risks and costs according to Deutsche Bank’s conclusion.

![]() On Thursday, Microsoft’s market cap reached $1 trillion following the release of its earnings report, which showed an annual increase of 14% in revenue and 20% in earnings per share.

On Thursday, Microsoft’s market cap reached $1 trillion following the release of its earnings report, which showed an annual increase of 14% in revenue and 20% in earnings per share.

![]() On Friday 26 April, President Xi stated in a speech that China will not pursue Yuan depreciation that would harm other countries. Instead, China will be in focus of lowering tariffs and improving IP rights protection.

On Friday 26 April, President Xi stated in a speech that China will not pursue Yuan depreciation that would harm other countries. Instead, China will be in focus of lowering tariffs and improving IP rights protection.

![]()

![]()

![]() China manufacturing PMI for April will be released on Tuesday 30 April and is expected to come in at 50.6.

China manufacturing PMI for April will be released on Tuesday 30 April and is expected to come in at 50.6.

![]() US unemployment rate will be released on Friday 3 May and is expected at 3.8%.

US unemployment rate will be released on Friday 3 May and is expected at 3.8%.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 24/04/19

Notice:

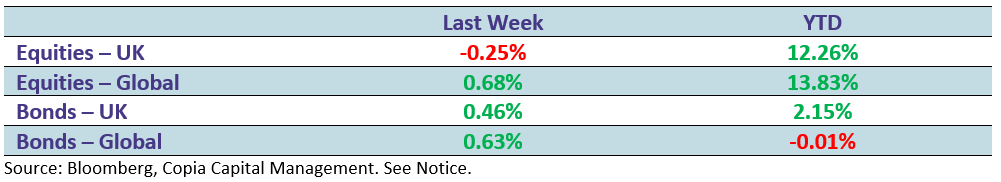

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.