![]()

- The Bank of England raised its benchmark rate for the first time in over a decade, with the base rate increasing to 0.5%. However, the Pound (£) fell versus peers on this news, as the guidance given by the BoE was seen to be dovish

- US President, Donald Trump, announced that Jerome H. Powell has been nominated as the Federal Reserve’s new Chair. Market economists believe Powell’s policies will be consistent with current chairwoman, Janet Yellen

- Bitcoin, the highly popular cryptocurrency, has continued its upward surge by reaching a new high of $7,000 after it was announced that CME Group, the Chicago-based exchange operator, said it will look to create Bitcoin futures

- Venezuelan President, Nicolás Maduro, announced that Venezuela would look to restructure and refinance its debts after their state oil company makes one more payment, blaming U.S. sanctions for making it impossible to find new financing

![]()

![]()

- On Thursday 9 November we will see the release of UK Industrial Production MoM with markets expecting a 0.2% increase on the previous month

- On Thursday 9 November we will see the release of US Wholesalers Inventories with markets expecting a total monthly change of 0.3%

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/10/17

Notice:

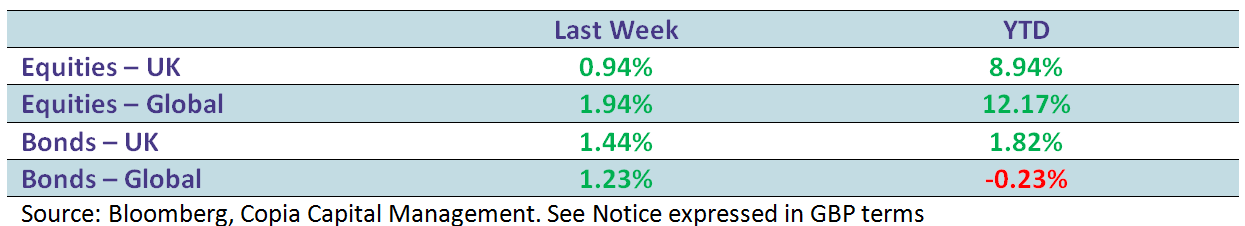

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.