![]()

![]() On Monday 18 March, the international financial services company Fidelity National Information Services (FIS) announced an agreed deal to acquire Worldpay, the US payment processing company for approximately $35bn. The combined firm will keep the name of FIS.

On Monday 18 March, the international financial services company Fidelity National Information Services (FIS) announced an agreed deal to acquire Worldpay, the US payment processing company for approximately $35bn. The combined firm will keep the name of FIS.

![]() On Wednesday 20 March, US Fed announced to hold the federal funds rate of 2.25%-2.5% and signalled that they will maintain the current rates through 2019 and expect just one rate hike in 2020. Meanwhile, the Fed noted that the US labour market remains strong while the growth of economic activity is flattening.

On Wednesday 20 March, US Fed announced to hold the federal funds rate of 2.25%-2.5% and signalled that they will maintain the current rates through 2019 and expect just one rate hike in 2020. Meanwhile, the Fed noted that the US labour market remains strong while the growth of economic activity is flattening.

![]() On Thursday 21 March, European Council President Donald Tusk offered the UK an extension on Brexit to 22 May, provided that UK MPs need to pass the withdrawal agreement. In the case that the withdrawal agreement is rejected again, the EU would accept a shorter extension until 12 April.

On Thursday 21 March, European Council President Donald Tusk offered the UK an extension on Brexit to 22 May, provided that UK MPs need to pass the withdrawal agreement. In the case that the withdrawal agreement is rejected again, the EU would accept a shorter extension until 12 April.

![]() On Friday 22 March, German Manufacturing PMI for March was released, decreasing to 44.7, which is well below the expected reading of 48 by economists. This means German manufacturing sector slid into contraction.

On Friday 22 March, German Manufacturing PMI for March was released, decreasing to 44.7, which is well below the expected reading of 48 by economists. This means German manufacturing sector slid into contraction.

![]()

![]()

![]() US trade balance for January will be announced on Wednesday 27 March, with an expected deficit at $57.5bn.

US trade balance for January will be announced on Wednesday 27 March, with an expected deficit at $57.5bn.

![]() China manufacturing PMI for March will be released on Sunday 31 March and is expected to come in at 49.6.

China manufacturing PMI for March will be released on Sunday 31 March and is expected to come in at 49.6.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 01/03/2019

Notice:

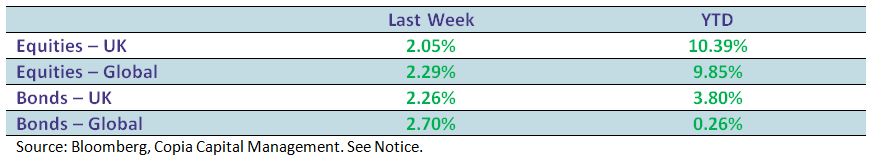

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.