![]()

![]() On Tuesday 5 March, Trump announced the plan to terminate the preferential trade treatments for India and Turkey, accusing India with failing to provide equitable trade access and stating that Turkey is “sufficiently economically developed”, so it will no longer be qualified for the benefits.

On Tuesday 5 March, Trump announced the plan to terminate the preferential trade treatments for India and Turkey, accusing India with failing to provide equitable trade access and stating that Turkey is “sufficiently economically developed”, so it will no longer be qualified for the benefits.

![]() On Thursday 7 March, the ECB announced the decision to keep the current benchmark interest rate unchanged at 0% and cut the growth forecast of the economy for 2019 from 1.7% to 1.1%. The bank is going to launch a refinancing programme – TLTRO-3 in September, which aims to help preserve favourable bank lending conditions in the euro area.

On Thursday 7 March, the ECB announced the decision to keep the current benchmark interest rate unchanged at 0% and cut the growth forecast of the economy for 2019 from 1.7% to 1.1%. The bank is going to launch a refinancing programme – TLTRO-3 in September, which aims to help preserve favourable bank lending conditions in the euro area.

![]() On Thursday, Chinese technology company Huawei filed a lawsuit against the US government over the ban that prohibits federal agencies from using Huawei products.

On Thursday, Chinese technology company Huawei filed a lawsuit against the US government over the ban that prohibits federal agencies from using Huawei products.

![]() On Friday 8 March, China released the trade data for February, which showed exports dropping by 20.7% YoY. Meanwhile Beijing expressed concerns over the possibility of reaching final trade agreement with the US. Trade worries triggered a plummet in Chinese stocks on Friday.

On Friday 8 March, China released the trade data for February, which showed exports dropping by 20.7% YoY. Meanwhile Beijing expressed concerns over the possibility of reaching final trade agreement with the US. Trade worries triggered a plummet in Chinese stocks on Friday.

![]()

![]()

![]() US CPI will be released on Tuesday 12 March and is expected to come in at 1.6% YoY.

US CPI will be released on Tuesday 12 March and is expected to come in at 1.6% YoY.

![]() UK trade balance for January will be announced on Tuesday 12 March, with an expected deficit of £3,371m.

UK trade balance for January will be announced on Tuesday 12 March, with an expected deficit of £3,371m.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 01/03/2019

Notice:

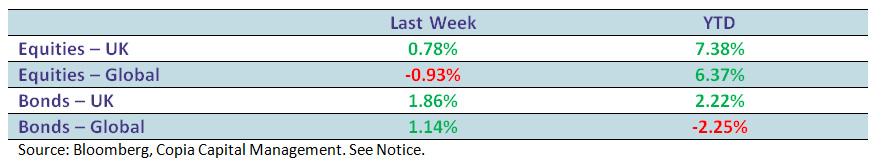

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.