![]()

![]() On Sunday 24 February, Trump announced that the US will delay the increased tariffs on $200bn Chinese goods scheduled for 1 March without setting another deadline, as progress to reach a trade deal between US and China has been achieved during trade talks.

On Sunday 24 February, Trump announced that the US will delay the increased tariffs on $200bn Chinese goods scheduled for 1 March without setting another deadline, as progress to reach a trade deal between US and China has been achieved during trade talks.

![]() On Thursday 28 February, the meeting between US President Trump and North Korea leader Kim Jong-un ended abruptly. The planned working lunch on the day and a bilateral deal that was supposed to be signed were both cancelled.

On Thursday 28 February, the meeting between US President Trump and North Korea leader Kim Jong-un ended abruptly. The planned working lunch on the day and a bilateral deal that was supposed to be signed were both cancelled.

![]() On Thursday, the chief executive of Norway’s sovereign wealth fund, one of the UK’s biggest foreign investors, Yngve Slyngstad expressed confidence in the UK economy in the long run after Brexit and stated that the fund will maintain its exposure to the UK.

On Thursday, the chief executive of Norway’s sovereign wealth fund, one of the UK’s biggest foreign investors, Yngve Slyngstad expressed confidence in the UK economy in the long run after Brexit and stated that the fund will maintain its exposure to the UK.

![]() Also on Thursday, US Fed Chairman Jerome Powell repeated in his speech that the US economy is in a good place and the Fed will be patient on future rate hikes, aiming to support Fed’s “dual-mandate objectives”, the maximum employment rate and price stability.

Also on Thursday, US Fed Chairman Jerome Powell repeated in his speech that the US economy is in a good place and the Fed will be patient on future rate hikes, aiming to support Fed’s “dual-mandate objectives”, the maximum employment rate and price stability.

![]()

![]()

![]() US will publish the change in Nonfarm payrolls for February on Friday 8 March, which is expected at 185K.

US will publish the change in Nonfarm payrolls for February on Friday 8 March, which is expected at 185K.

![]() US unemployment rate will be released on Friday and is expected at 3.9%.

US unemployment rate will be released on Friday and is expected at 3.9%.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 01/03/2019

Notice:

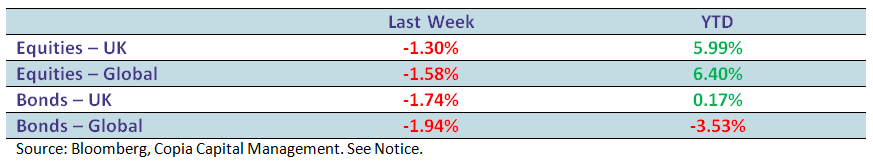

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.