![]()

![]() On Wednesday 20 February, the US Fed released minutes from its January FOMC meeting, showing a dovish stance of policymakers who emphasised the downside risks and uncertainty in economic outlook.

On Wednesday 20 February, the US Fed released minutes from its January FOMC meeting, showing a dovish stance of policymakers who emphasised the downside risks and uncertainty in economic outlook.

![]() Also on Wednesday, Lloyds reported its profit for 2018, which jumped 13% YoY to £6bn and EPS stood at 5.5 pence. The bank announced that it will pay an annual dividend of 3.21p per share and will spend £1.8bn on stock buyback, which means a total of £4bn will be distributed to shareholders.

Also on Wednesday, Lloyds reported its profit for 2018, which jumped 13% YoY to £6bn and EPS stood at 5.5 pence. The bank announced that it will pay an annual dividend of 3.21p per share and will spend £1.8bn on stock buyback, which means a total of £4bn will be distributed to shareholders.

![]() On Friday 22 February, the oil company Saudi Aramco announced that a joint venture valued at $10bn has been signed with Chinese corporations Norinco and Panjin Sincen. The deal led to a new company held by the three firms and it aims to develop an integrated refining and petrochemical complex.

On Friday 22 February, the oil company Saudi Aramco announced that a joint venture valued at $10bn has been signed with Chinese corporations Norinco and Panjin Sincen. The deal led to a new company held by the three firms and it aims to develop an integrated refining and petrochemical complex.

![]() German GDP growth for Q4 2018 came in at 0.0% QoQ on Friday, showing stagnation compared to the previous quarter.

German GDP growth for Q4 2018 came in at 0.0% QoQ on Friday, showing stagnation compared to the previous quarter.

![]()

![]()

![]() China manufacturing PMI will be released on Thursday 28 February and is expected to come in at 49.5.

China manufacturing PMI will be released on Thursday 28 February and is expected to come in at 49.5.

![]() Eurozone unemployment will be published on Friday 1 March and is expected at 7.9%.

Eurozone unemployment will be published on Friday 1 March and is expected at 7.9%.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 18/02/19

Notice:

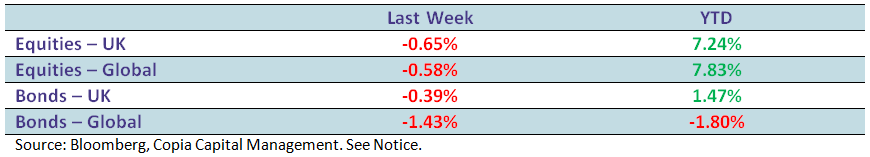

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.