![]()

![]() On Tuesday 12 February, OPEC published the monthly report for January, showing cuts in production led by Saudi Arabia, which reduced its output by 350,000 barrels per day and the total cut within the organisation amounted to 797,000 barrels per day.

On Tuesday 12 February, OPEC published the monthly report for January, showing cuts in production led by Saudi Arabia, which reduced its output by 350,000 barrels per day and the total cut within the organisation amounted to 797,000 barrels per day.

![]() On Wednesday 13 February, UK and US both released CPI for January, with UK index increasing by 1.8% YoY, the lowest level in two years and US index coming in at 1.6% YoY, decreasing from 1.9% from previous reading.

On Wednesday 13 February, UK and US both released CPI for January, with UK index increasing by 1.8% YoY, the lowest level in two years and US index coming in at 1.6% YoY, decreasing from 1.9% from previous reading.

![]() On Thursday, SoftBank Group announced a share buyback of $5.46bn or 10.3% of its market value after its earnings report. Sony followed the repurchase plan, by announcing its own $910 million share buyback on Friday 8 February.

On Thursday, SoftBank Group announced a share buyback of $5.46bn or 10.3% of its market value after its earnings report. Sony followed the repurchase plan, by announcing its own $910 million share buyback on Friday 8 February.

![]() On Friday 15 February, the German online marketplace operator Scout24 announced that it will accept the takeover offer from Blackstone, at the price of €5.70bn.

On Friday 15 February, the German online marketplace operator Scout24 announced that it will accept the takeover offer from Blackstone, at the price of €5.70bn.

![]()

![]()

![]() US manufacturing PMI will be released on Thursday 21 February and is expected to come in at 54.9.

US manufacturing PMI will be released on Thursday 21 February and is expected to come in at 54.9.

![]() Eurozone CPI will be published on Friday 22 February and is expected at 1.1% YoY.

Eurozone CPI will be published on Friday 22 February and is expected at 1.1% YoY.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/01/19

Notice:

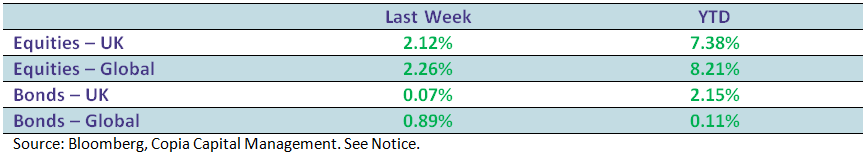

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.