![]()

![]() On Wednesday 30 January, the Fed announced to keep the current benchmark interest rate unchanged at 2.25%. Following the decision, the Fed stated that it will stay patient on future rate hikes, commenting that the economic growth of the US is at a solid rate.

On Wednesday 30 January, the Fed announced to keep the current benchmark interest rate unchanged at 2.25%. Following the decision, the Fed stated that it will stay patient on future rate hikes, commenting that the economic growth of the US is at a solid rate.

![]() Facebook, Alibaba, Microsoft published their quarterly earnings on Wednesday. Facebook’s revenue for Q4 2018 increased 30% YoY and EPS jumped by 65% YoY, standing at $2.38. Facebook stock rallied over 10% on the announcement.

Facebook, Alibaba, Microsoft published their quarterly earnings on Wednesday. Facebook’s revenue for Q4 2018 increased 30% YoY and EPS jumped by 65% YoY, standing at $2.38. Facebook stock rallied over 10% on the announcement.

![]() On Thursday 31 January, Italy published the national GDP growth for Q4 2018, which showed a contraction of 0.2% compared to previous quarter. The persistently declining GDP for two consecutive quarters indicates that Italy has slipped into a recession.

On Thursday 31 January, Italy published the national GDP growth for Q4 2018, which showed a contraction of 0.2% compared to previous quarter. The persistently declining GDP for two consecutive quarters indicates that Italy has slipped into a recession.

![]() China promised to substantially increase imports from the US after the US-China trade talks last week. The purchases will cover the agriculture, energy, industrial products and services from the US.

China promised to substantially increase imports from the US after the US-China trade talks last week. The purchases will cover the agriculture, energy, industrial products and services from the US.

![]()

![]()

![]() US trade balance for November will be announced on Wednesday 6 February, with an expected deficit at $54.0bn.

US trade balance for November will be announced on Wednesday 6 February, with an expected deficit at $54.0bn.

![]() Bank of England will announce bank rate on Thursday 7 February, which is expected to stay at 0.75%.

Bank of England will announce bank rate on Thursday 7 February, which is expected to stay at 0.75%.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 17/01/19

Notice:

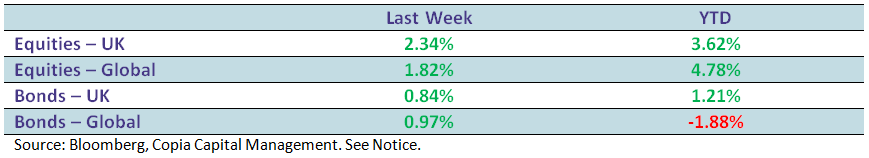

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.