![]()

![]() On Tuesday January 16, May’s withdrawal agreement with the EU was rejected by the UK Parliament with 432 MPs voting against the deal including 118 Conservative MPs. On Wednesday January 17, the Conservative government survived a no-confidence vote tabled by Jeremy Corbyn and will continue to stay in power.

On Tuesday January 16, May’s withdrawal agreement with the EU was rejected by the UK Parliament with 432 MPs voting against the deal including 118 Conservative MPs. On Wednesday January 17, the Conservative government survived a no-confidence vote tabled by Jeremy Corbyn and will continue to stay in power.

![]() Germany issued a report expressing the security concerns of Huawei building 5G networks across the country. The government is considering raising the security requirements of 5G infrastructure, which would impact the use of Huawei products in Germany.

Germany issued a report expressing the security concerns of Huawei building 5G networks across the country. The government is considering raising the security requirements of 5G infrastructure, which would impact the use of Huawei products in Germany.

![]() On Thursday January 17, the forecasts from a Reuters Poll showed that the full-year economic growth of China for 2018 is expected at 6.6% while for 2019, the expansion is expected at a lower rate at 6.3%, due to the weakening global demand.

On Thursday January 17, the forecasts from a Reuters Poll showed that the full-year economic growth of China for 2018 is expected at 6.6% while for 2019, the expansion is expected at a lower rate at 6.3%, due to the weakening global demand.

![]() On Friday January 18, Tesla was reported to cut its workforce by 7% according to a memo from Elon Musk, aiming at cutting costs and hence lowering the product price. On the same day, Tesla recalled 14,000 S Electric Cars in China due to defects in the airbags.

On Friday January 18, Tesla was reported to cut its workforce by 7% according to a memo from Elon Musk, aiming at cutting costs and hence lowering the product price. On the same day, Tesla recalled 14,000 S Electric Cars in China due to defects in the airbags.

![]()

![]()

![]() China GDP growth for Q4 will be released on Monday January 21, at an expected rate of 6.4% YoY.

China GDP growth for Q4 will be released on Monday January 21, at an expected rate of 6.4% YoY.

![]() The US trade balance for November will be announced on Tuesday January 22, with an expected deficit of $54.0bn.

The US trade balance for November will be announced on Tuesday January 22, with an expected deficit of $54.0bn.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 17/01/19

Notice:

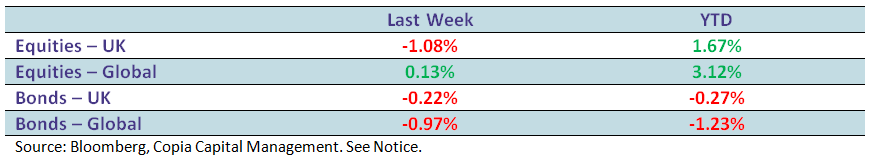

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.