![]()

- UK Inflation reached the highest level in more than five years, during the month of September, when consumer prices rose 3%, according to the Office for National Statistics in London.

- It is expected that President Donald Trump will pick Federal Reserve Governor Jay Powell to be the next Federal Reserve chairman, in what has become a much anticipated decision, now expected before November 3rd.

- The Spanish government is expected to start suspending Catalonia’s autonomy, stating ministers would seek to meet to activate Article 155 of the constitution, allowing it to take over running of the region.

- On the eve of the 30th anniversary of the famed “Black Monday” crash, the Dow Jones breached the 23,000 level for the first time as hopes were buoyed that President Donald Trump could make progress on implementing tax cut plans and additional support coming from a raft of recent solid corporate earnings.

![]()

![]()

- On Wednesday 25th we will see the release of UK Chained GDP YoY, with the market expecting this to be at 1.5%.

- On Wednesday 25th we will also see the release of US New One Family House Sales, with the market expecting this to be at 555,000.

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/09/17

Notice:

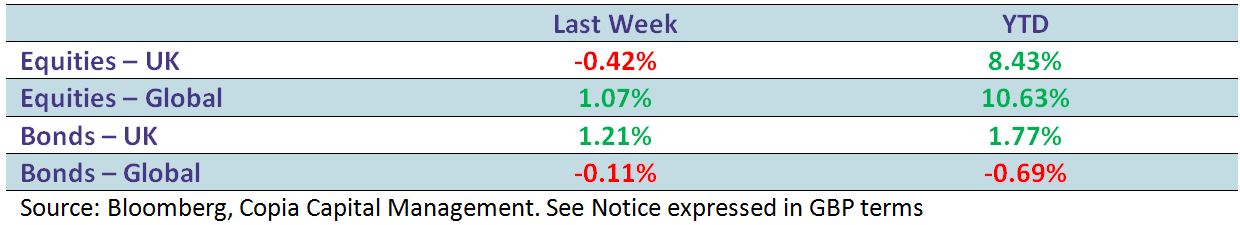

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.