![]()

![]() On Tuesday 8 January, an amendment to the Finance Bill was passed, which will restrict the UK government’s power to make tax changes in the case of a no-deal Brexit, unless it receives “explicit consent” from Parliament.

On Tuesday 8 January, an amendment to the Finance Bill was passed, which will restrict the UK government’s power to make tax changes in the case of a no-deal Brexit, unless it receives “explicit consent” from Parliament.

![]() On Thursday January 10, the car manufacturer Ford Motor announced a decision to cut cost and improve profitability, which could impact thousands of jobs by estimate. Blackrock was also reported to cut roughly 3% of its workforce on Friday January 11, to improve operation by turning focus to technology and more important strategic growth opportunities.

On Thursday January 10, the car manufacturer Ford Motor announced a decision to cut cost and improve profitability, which could impact thousands of jobs by estimate. Blackrock was also reported to cut roughly 3% of its workforce on Friday January 11, to improve operation by turning focus to technology and more important strategic growth opportunities.

![]() A three-day trade talk between the US and China ended on Wednesday. After the meeting, the US confirmed China’s commitment to purchase “a substantial amount of agricultural, energy, manufactured goods, and other products and services.”

A three-day trade talk between the US and China ended on Wednesday. After the meeting, the US confirmed China’s commitment to purchase “a substantial amount of agricultural, energy, manufactured goods, and other products and services.”

![]() The “meaningful vote” on Theresa May’s Brexit withdrawal agreement, which is rescheduled for Wednesday January 15 was postponed previously by May as it became clear that over 100 Conservative MPs would vote against her proposal.

The “meaningful vote” on Theresa May’s Brexit withdrawal agreement, which is rescheduled for Wednesday January 15 was postponed previously by May as it became clear that over 100 Conservative MPs would vote against her proposal.

![]()

![]()

![]() China trade balance for December will be announced on Monday January 14, with an expected surplus of CNY345.0bn.

China trade balance for December will be announced on Monday January 14, with an expected surplus of CNY345.0bn.

![]() UK CPI will be released on Wednesday January 16 and is expected to come in at 2.2% YoY.

UK CPI will be released on Wednesday January 16 and is expected to come in at 2.2% YoY.

![]()

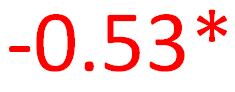

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/12/18

Notice:

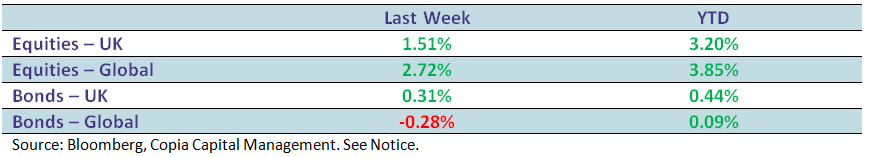

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.