Last week:

![]() The US Fed raised rates by another 0.25% on Wednesday, December 19, consistent with their previous communication citing robust economic growth to continue, but trimmed its projection of future rate hikes for 2019. US stock markets extended losses as participants expected Fed to slowdown monetary tightening in light of the recent volatility.

The US Fed raised rates by another 0.25% on Wednesday, December 19, consistent with their previous communication citing robust economic growth to continue, but trimmed its projection of future rate hikes for 2019. US stock markets extended losses as participants expected Fed to slowdown monetary tightening in light of the recent volatility.

![]() The European Commission said it has started to implement its preparations for a no-deal Brexit, while the UK has allocated £2bn in funding to government departments in preparation of no-deal Brexit. UK companies are also kicking contingency plans in gear as they prepare for the worst.

The European Commission said it has started to implement its preparations for a no-deal Brexit, while the UK has allocated £2bn in funding to government departments in preparation of no-deal Brexit. UK companies are also kicking contingency plans in gear as they prepare for the worst.

![]() On a positive note, the US and China have agreed to restart trade negotiations in January 2019 and hope to reach a deal on tariffs.

On a positive note, the US and China have agreed to restart trade negotiations in January 2019 and hope to reach a deal on tariffs.

![]() Oil price extended losses with WTI, US crude oil, touching $45 a barrel, losing more than 40% in a span of 2 months.

Oil price extended losses with WTI, US crude oil, touching $45 a barrel, losing more than 40% in a span of 2 months.

Market Pulse:

Coming up:

![]() US New Home Sales data will be released on Thursday December 27, with an expected growth of 2%.

US New Home Sales data will be released on Thursday December 27, with an expected growth of 2%.

Copia’s Risk Barometer:

Copia’s Risk Barometer:

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/11/2018

Notice:

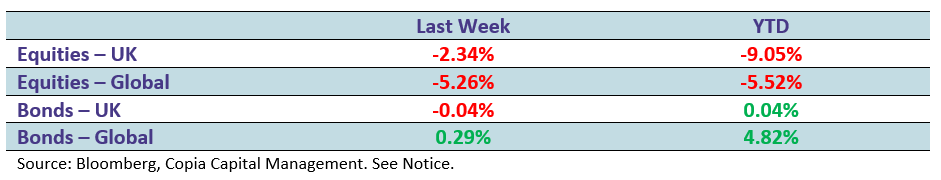

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.