![]()

![]() On Monday November 26, General Motors announced its restructuring plan for the next year, to decrease production at several factories in the US and Canada and close down another two outside North America, meanwhile laying off more than 14,000 employees.

On Monday November 26, General Motors announced its restructuring plan for the next year, to decrease production at several factories in the US and Canada and close down another two outside North America, meanwhile laying off more than 14,000 employees.

![]() On Tuesday November 27, Italy was reported to offer a concession budget proposal to the EU, which lowers the planned budget deficit from 2.4% to 2.2% of the GDP for 2019. However, it was rejected again by the European Commission on Wednesday, which claimed that a more substantial correction is needed.

On Tuesday November 27, Italy was reported to offer a concession budget proposal to the EU, which lowers the planned budget deficit from 2.4% to 2.2% of the GDP for 2019. However, it was rejected again by the European Commission on Wednesday, which claimed that a more substantial correction is needed.

![]() In the speech delivered by Jerome Powell on Wednesday November 28, Mr Powell stressed that the current US benchmark interest rate (2.25%) is just below the neutral level, in contrast to his remarks in October when he said the rate is “a long way off neutral”.

In the speech delivered by Jerome Powell on Wednesday November 28, Mr Powell stressed that the current US benchmark interest rate (2.25%) is just below the neutral level, in contrast to his remarks in October when he said the rate is “a long way off neutral”.

![]() Oil price extended the loss during the past week with the US crude oil falling below $50 a barrel on Thursday November 28, the lowest level since October 4, 2017.

Oil price extended the loss during the past week with the US crude oil falling below $50 a barrel on Thursday November 28, the lowest level since October 4, 2017.

![]()

![]()

![]() US trade balance for October will be announced on Thursday November 6, with an expected deficit at $54.0bn.

US trade balance for October will be announced on Thursday November 6, with an expected deficit at $54.0bn.

![]() On Friday December 7, Eurozone GDP growth will be released, at an expected rate of 1.7% YoY.

On Friday December 7, Eurozone GDP growth will be released, at an expected rate of 1.7% YoY.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 19/11/18

Notice:

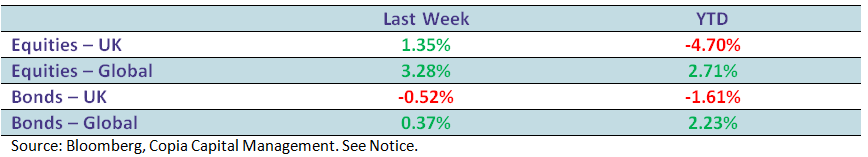

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.